We Weren’t Saving for Retirement Before, Now it’s Even Harder

UpdatedJan 20, 2026

- Research shows that many are unprepared for retirement.

- Unemployment, especially for older workers, makes saving for retirement difficult.

- Clearing debt and establishing a retirement saving habit is critical for workers of all ages.

Table of Contents

When it comes to saving for retirement, many Americans have difficulty building their nest egg because money needs to go to pressing needs like paying bills, saving for short-term goals, and staying on top of debt. Now, due to the increase in unemployment during the coronavirus pandemic, saving for retirement has become an even bigger struggle.

And now, new research published by the Center for Retirement Research at Boston College reveals many Americans might not be able to maintain their pre-retirement standard of living.

Let’s take a closer look at why it may be harder to save for retirement right now, and a few ideas to help you get back to saving consistently.

Widespread unemployment

While unemployment has made it nearly impossible to save for retirement, average retirement savings were not strong pre-pandemic either, with 41% of Americans saying they did not set aside any money for their household retirement plan. Retirement preparedness can be measured using the National Retirement Risk Index (NRRI) created by the Center for Retirement Research at Boston College.

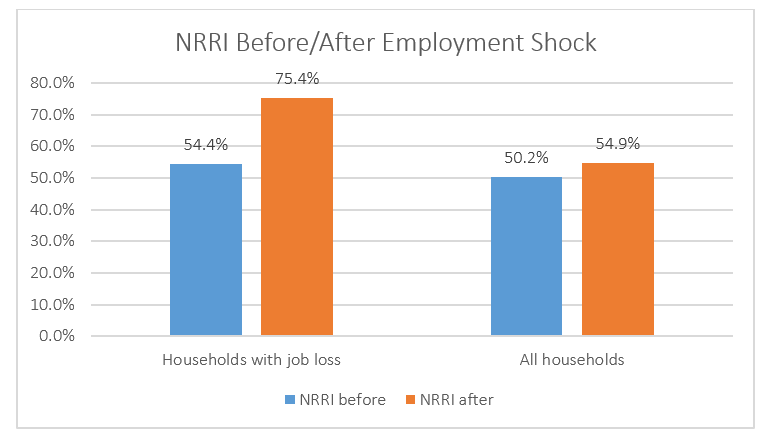

The NRRI measures a household’s retirement income as a percentage of their pre-retirement income to determine who is at risk of not being able to maintain their standard of living later on. More than 75% of households who have experienced job loss are now at risk of not being able to maintain their standard of living during retirement. Even among those still employed, nearly 55% of all households are at risk.

Source: Center for Retirement Research at Boston College

While the risk was high before the pandemic, unemployment has created even more hardship to those who want to retire comfortably. As a result, fewer Americans are able to save each year.

The savings gap has increased

Lack of savings, coupled with unemployment, has led to an increase in the difference between what households have actually saved in a given year and what they should have saved in order to maintain their living standard in retirement.

Savings Gap to Income, by Income Group, Before/After Employment Shock

| Income | Before | After | Percentage Change |

|---|---|---|---|

| Low | 19.7% | 24.2% | 4.5% |

| Middle | 14.4 | 18.1 | 3.7 |

| High | 15.4 | 18.3 | 2.9 |

| All | 16.7% | 20.4% | 3.7% |

Source: Center for Retirement Research at Boston College

Low-income households have been impacted the most by rising unemployment. While the savings gap was nearly 20% for these households before the employment shock, it increased by 4.5% — the highest out of all income groups. So if you’re low income and close to retirement age, you could run a very high risk of not being able to maintain your current lifestyle once you retire.

Older workers are at a higher risk

Older workers who have lost their jobs are often more vulnerable to a rocky retirement because they have less time to make up for lost income before they’ll need to start withdrawing from their investment, pension or government funds. In addition, it can be harder for older workers to become re-employed, even white-collar workers. Those workers typically hold more seasoned positions, like management or senior-level jobs, which can take more time to find and are more costly to employers.

In a normal unemployment scenario, a job search can take between 8 to 12 weeks, but finding an executive-level position can take anywhere from six months to a year. If you’re vying for a top position, that could mean going almost a full year without being able to contribute to your retirement.

But in a time of widespread unemployment, it is not just the high-level managers who will struggle. Blue-collar jobs in the construction and manufacturing industries have nearly tripled in unemployment since last year. While the reality may seem like a blow to your bottom line, there are a few things you can do to continue saving for retirement right now.

Close to retirement? Here’s what to do

If retirement is just around the corner, there’s a few things you can do to tighten your existing savings so you’re better prepared.

Make up for retirement losses by reducing your lifestyle. Now is the time to go inside your budget and look for expenses that you can eliminate. Monthly subscriptions, clothes, and shopping are good places to start, but consider reviewing expenses like insurance premiums. A few changes in coverage could reveal continuing savings.

Keep your investments conservative. As you get closer to retirement, review your investment strategy. Moving to more conservative funds, like bonds or annuities, can help reduce your risk of losing money in the stock market. Discuss your approach with a financial advisor.

Avoid credit card debt. It’s no fun spending your life’s savings on paying down credit card debt, so avoid adding to it. That means using cash to pay for regular purchases and being more mindful of online purchases and impulse buys.

Even once you are employed again, experts recommend continue living a reduced lifestyle so you can push the extra savings towards retirement.

People just like you are seeking debt relief in Phoenix, AZ and across the country. The first step is the most important one—explore your options.

Further from retirement? Steps to take

You still have plenty of time to catch up and keep the coronavirus from impacting your retirement savings if you aren’t close to retirement age, but you still need to start planning.

Contribute to an employer-sponsored retirement plan. A 401(k), 403(b), or Thrift Savings Plan is a great start to building your retirement savings. You can start small while you get back on your feet and progressively work up to a larger contribution later on.

Assess your investment risk level. If you still have decades before you retire, take a look at the types of funds to invest in. Riskier investments, like stocks, are often high risk, high reward. If time is on your side, you may be better able to ride out the dips in the stock market for a better return. Consult with a financial advisor on what could be the best approach for you.

Reduce debt as much as possible. The more you can pay off debt now, the more money you may free up to contribute to your future. Work on a debt pay off strategy and don’t be afraid to enlist a spouse or friend to support you along your debt-free journey.

Debt shouldn’t keep you from saving for retirement

If you are having trouble keeping debt at bay and figuring out life after you retire, there are a few ways to get you back on your feet. Our free debt management guide can walk you through your options on how to manage debt, save money, and choose the right solution, including our debt relief program. Start by downloading our “How to Manage Debt” guide right now.

Learn more:

5 Best Apps to Effortlessly Save for Retirement(Freedom Debt Relief)

60% of Americans Aren’t Saving Enough for Retirement (Freedom Debt Relief)

Unemployed? Here’s How to Keep Managing Your Credit Card Debt (Freedom Debt Relief)

Many Older Workers Would Prefer to Ease into Retirement (SHRM)

Debt relief by the numbers

We looked at a sample of data from Freedom Debt Relief of people seeking credit card debt relief during December 2025. This data reveals the diversity of individuals seeking help and provides insights into some of their key characteristics.

Credit utilization and debt relief

How are people using their credit before seeking help? Credit utilization measures how much of a credit line is being used. For example, if you have a credit line of $10,000 and your balance is $3,000, that is a credit utilization of 30%. High credit utilization often signals financial stress. We have looked at people who are seeking debt relief and their credit utilization. (Low credit utilization is 30% or less, medium is between 31% and 50%, high is between 51% and 75%, very high is between 76% to 100%, and over-utilized over 100%). In December 2025, people seeking debt relief had an average of 74% credit utilization.

Here are some interesting numbers:

| Credit utilization bucket | Percent of debt relief seekers |

|---|---|

| Over utilized | 30% |

| Very high | 32% |

| High | 19% |

| Medium | 10% |

| Low | 9% |

The statistics refer to people who had a credit card balance greater than $0.

You don't have to have high credit utilization to look for a debt relief solution. There are a number of solutions for people, whether they have maxed out their credit cards or still have a significant part available.

Collection accounts balances – average debt by selected states.

Collection debt is one example of consumers struggling to pay their bills. According to 2023, data from the Urban Institute, 26% of people had a debt in collection.

In December 2025, 30% of debt relief seekers had a collection balance. The average amount of open collection account debt was $3,203.

Here is a quick look at the top five states by average collection debt balance.

| State | % with collection balance | Avg. collection balance |

|---|---|---|

| District of Columbia | 23 | $4,899 |

| Montana | 24 | $4,481 |

| Kansas | 32 | $4,468 |

| Nevada | 32 | $4,328 |

| Idaho | 27 | $4,305 |

The statistics are based on all debt relief seekers with a collection account balance over $0.

If you’re facing similar challenges, remember you’re not alone. Seeking help is a good first step to managing your debt.

Tackle Financial Challenges

Don’t let debt overwhelm you. Learn more about debt relief options. They can help you tackle your financial challenges. This is true whether you have high credit card balances or many tradelines. Start your path to recovery with the first step.

Show source

Author Information

Written by

Justine Nelson

Justine Nelson is the founder of Debt Free Millennials, an online community to help millennials eliminate debt and live a debt free lifestyle. As a freelance writer and YouTuber, Justine enjoys creating upbeat and educational personal finance content. This Midwest millennial paid off $35k in student loan debt and now resides in San Diego with her husband.