Massachusetts Debt Relief: A 5-Year Review

Overall debt levels in Massachusetts have been fairly steady for the past 15 years, declining just $586 from 2023 to 2024 for a total of $76,400 average per resident according to the Federal Reserve Bank of New York. That's about $14,700 higher per capita than the national average. Just over three-quarters of total debt is attributed to mortgage debt, which makes sense in a state with high housing costs.

Massachusetts ranks first in the country for median household income at $104,800 compared to the U.S. average $81,604. Despite higher incomes, data from Freedom Debt Relief suggests many Massachusetts residents may be struggling with debt. The average debt relief seeker from Massachusetts had a debt-to-income (DTI) ratio of 39.4% with a minimum monthly debt payment of over $1,900 in 2024.

Emphasizing the point that a higher income doesn't always mean less debt, debt relief seekers in Massachusetts who owed the most debt and had the highest DTIs were consistently those with the highest incomes. In 2025, debt relief seekers with incomes over $200,000 had an average estimated debt of nearly $99,450 and an average DTI of 69.2%.

Bay Staters can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

5-Year Debt Trends in Massachusetts

Debt is up across the board across the last five years for debt relief seekers in Massachusetts. Amounts owed for both secured debt—debt backed by something of value, like mortgage or auto loans—and unsecured debt (debt with no collateral or security, like personal loans or credit cards) are higher than they were in 2020.

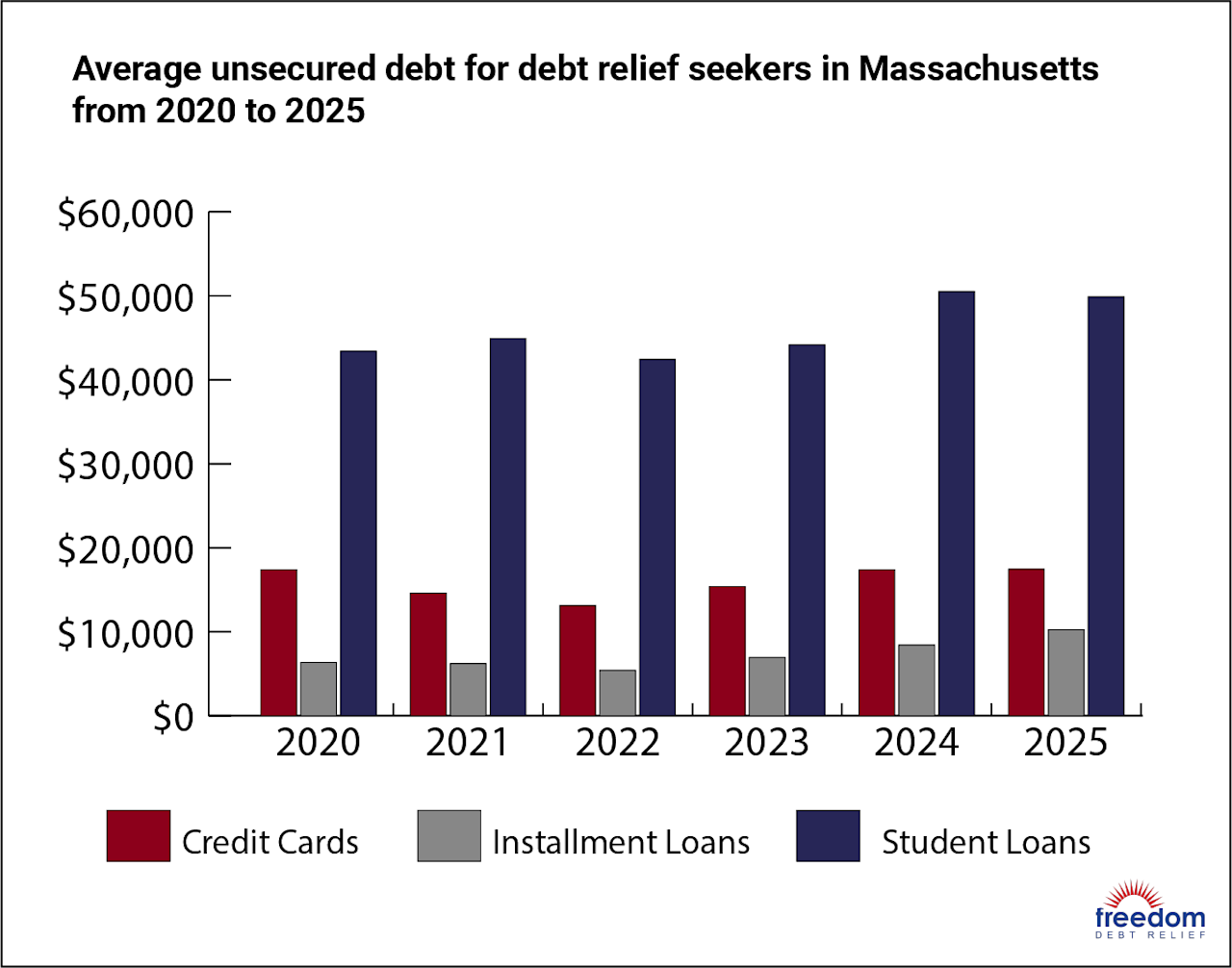

Unsecured debts have been the most tumultuous for debt relief seekers in Massachusetts, with numbers rising and falling significantly over the last five years. Despite some lows, however, 2020 to 2025 shows gains for each debt category.

Credit card debt is a good example, with debt relief seekers from Massachusetts owing an average of $17,461 in the beginning of 2025. That's close to the $17,383 average from 2020, but it's almost 25% higher than the low of $13,122 in 2022.

One notable change for debt relief seekers in Massachusetts has been a slight shift in the burden of debt by age bracket. From 2020 to 2023, folks in the 51 to 65 age bracket carried the most debt. Data from 2024 and early 2025 has the highest debts attributed to folks in the 36 to 50 age bracket. In the 2025 data, the 36-50 contingent had an estimated average debt of $33,098, while the older 51-65 age bracket had an average of $31,921.

Massachusetts credit card debt

Credit cards seem to be a popular payment method in Massachusetts—and a major source of debt. Early 2025 data shows the typical debt relief seeker in Massachusetts averages around $17,461 in credit card debt across eight credit cards. That's 0.6 more cards per person than the national average, and around 7.5% more credit card debt.

It's clear Massachusetts residents are putting those eight cards apiece to use. The average credit utilization (how much available credit you're using) for debt relief seekers in the state was 71% for the beginning of 2025—well above the 30% most experts recommend, though lower than the 73.5% for debt relief seekers overall.

Massachusetts debt relief seekers had monthly credit card payments totaling over $510 a month, which is only $25 a month higher than the U.S. average. While not far above average, however, those payments may still be too high for many folks. Massachusetts debt relief seekers have fallen behind on nearly a third of their credit card debt, with average credit card balances past due for early 2025 topping $6,100.

Massachusetts auto loan debt

Buying a car is more expensive than ever, but it's often a necessity that means taking on debt. Debt relief seekers in Massachusetts are doing better here than the U.S. overall, owing an average $22,287 in auto debt versus $26,997 nationally. That's a 17% difference.

With higher purchase prices come higher monthly payments, and Massachusetts debt relief seekers are paying $653 a month toward auto debt on average. Again, that's lower than the national average of $749—about 13%, or $96 a month, less per debt relief seeker.

Interestingly, while Massachusetts debt relief seekers owe less on their auto loans than average, they have almost the same number of them: 1.3 auto tradelines per debt relief seeker in Massachusetts versus a 1.5 average number of auto tradelines for U.S. debt relief seekers overall.

Massachusetts mortgage debt

Housing in Massachusetts is notoriously expensive, and the $702,400 average price tag for property in 2025 illustrates the problem. That's more than $240,000 higher than the national average.

So it's little surprise that debt relief seekers in Massachusetts have higher-than-typical mortgage debt. In early 2025, that mortgage debt totaled an average of $304,459 for residents of Massachusetts, compared to an overall national average of just $239,406. This means Massachusetts debt relief seekers owe an average of $65,053 more on their mortgages than U.S. debt relief seekers overall.

Larger mortgages come with higher monthly payments, and Massachusetts debt relief seekers are forking over an average of $2,500 a month for mortgage debt. That's 26% higher than the $1,989 that's average for the country.

Massachusetts installment loan debt

Folks in Massachusetts have a fairly typical number of installment loans—2.6 per person, on average in early 2025—compared to the average U.S. debt relief seeker with 2.8 loans each.

Despite having a similar number of loans, however, debt relief seekers in Massachusetts have less installment debt. They owed an average of $10,276 in installment debt in early 2025. That's about 23% less than the national average of $12,632 per debt relief seeker.

The monthly balances are similarly split. Massachusetts debt relief seekers paid an average of $458 a month for installment debt versus the U.S. average of $485 a month.

Massachusetts student loan debt

One area where Massachusetts debt relief seekers are right on par with the rest of the country is the all-too-common student loan debt. Residents had an average of 4.9 student loans per person in early 2025, just under the national average of 5.0 loans for the same timeframe.

Balances and payments are also about the same. Massachusetts debt relief seekers owed an average of $49,880 on their student loans, just $52 less than the average U.S. debt relief seeker. Despite owing slightly less, Massachusetts debt relief seekers are paying slightly more for their student loans each month at $367 versus the U.S. average of $313 a month.

Massachusetts Debt Delinquencies and Collections

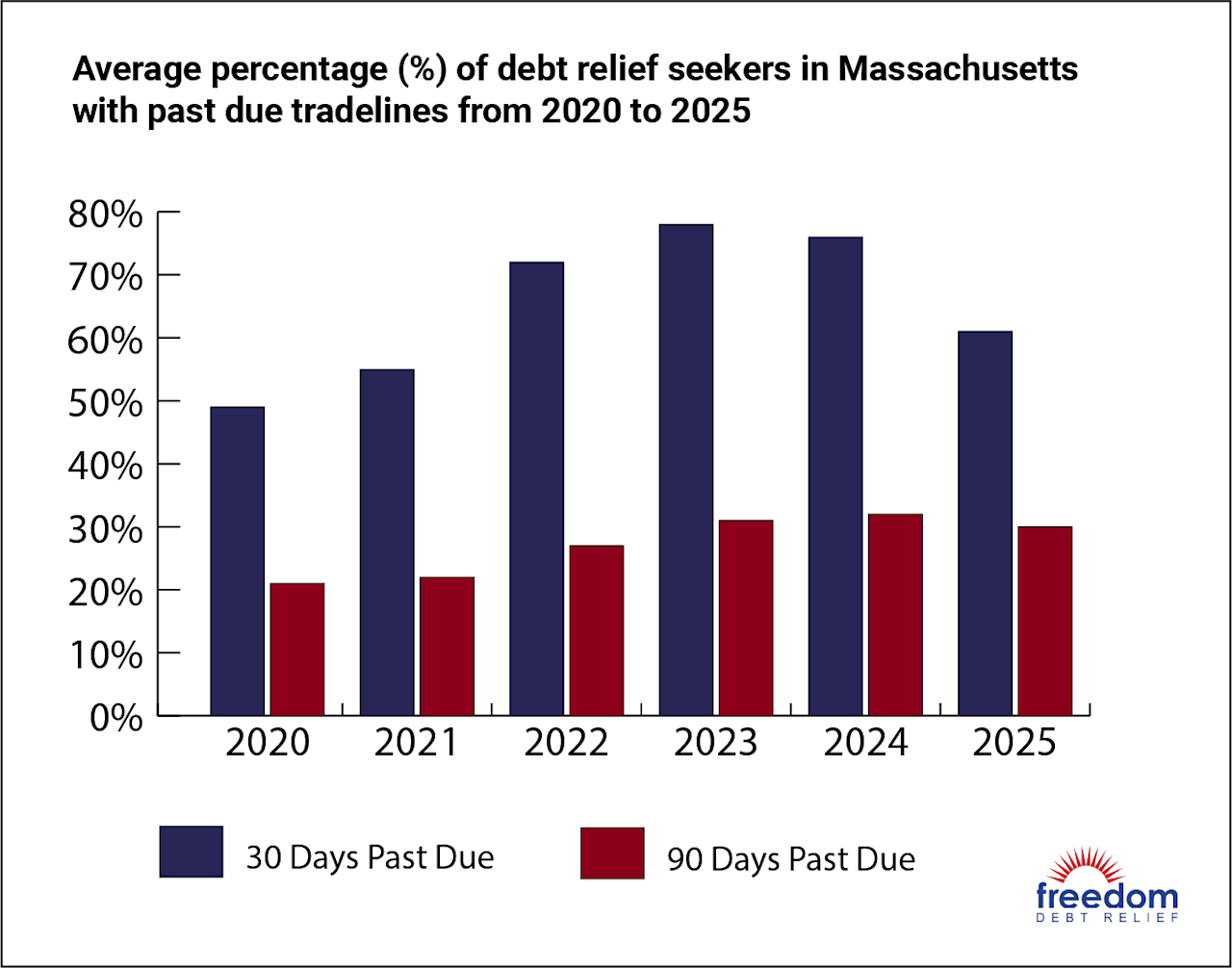

When it comes to past-due debt, Massachusetts residents seeking debt relief seem to be fairly close to the national average. An average of 61% of debt relief seekers in the state had at least one tradeline 30 days past due, which is just slightly above the 60% average nationally.

The 30-day mark is important because most accounts need to be at least 30 days past due to be reported to the credit bureaus as delinquent. Once it's reported as late, these accounts could cause damage to your credit scores.

Massachusetts is bang-on average when it comes to 90-day delinquent debt, with an average of 30% of debt relief seekers having at least one account 90-days past due both nationally and for the state.

One area where Massachusetts debt relief seekers are doing slightly better than the nationwide average is with collections debt. When an account is far enough overdue, it often gets sent to collections or sold to a collection agency.

Massachusetts debt relief seekers had an average of 1.5 tradelines in collections going into 2025, a bit lower than the 1.9 accounts on average for U.S. debt relief seekers overall. The amount of debt in collections for residents is also lower than the overall average at $2,691 for Massachusetts versus $3,040 overall.

Massachusetts Statute of Limitations

Most creditors and debt collectors in Massachusetts have the legal right to sue you and win to reclaim debt you owe. But that right doesn't last forever. The period of time a creditor is able to sue you for debt is called the statute of limitations. If you receive a court summons for debt that is past the statute of limitations (called time-barred debt), it’s important to respond and show up in court, to argue that the debt is uncollectable. In this instance, you could ask the judge to throw out the lawsuit.

In Massachusetts, the statute of limitations is six years for most types of debt, including credit card debt. This statute of limitations also applies to written or oral contracts that fall under Massachusetts law.

| Type of debt contract | Massachusetts statute of limitations |

|---|---|

| Written contracts | 6 years |

| Oral contracts | 6 years |

| Credit card debt | 6 years |

| Judgment | 20 years |

If you have a judgment against you, the statute of limitations on the original debt no longer applies. At that point, Massachusetts gives the judgment creditor 20 years to collect.

What are the Massachusetts debt collection laws?

The Massachusetts fair debt collection laws help protect consumers from debt collectors using unfair, deception or unreasonable practices. Here are some of the primary protections:

Debt collectors can't call you at home more than twice per debt per seven-day period. They also can't call you somewhere other than home (like work) more than twice per debt per 30-day period.

Debt collectors must always identify themselves on the call. They also can't call outside normal waking hours, which are presumed to be 8:00 am to 9:00 pm unless you tell them otherwise.

You can request that debt collectors don't call you at work. A verbal request lasts 10 days and a written request is valid until you reverse it.

If you have a lawyer, debt collectors can only contact your lawyer if directed to do so.

Debt collectors can't use threatening, profane, or obscene language. They also can't say they're going to take legal action if they don't intend to actually sue you.

Debt collectors should only talk to you about your debt. They can't talk about your debt with anyone you haven't given them written permission to contact (excluding credit reporting bureaus or legal agencies).

Reviews and Testimonials from Massachusetts

ANSWER ALL MY QUESTIONS

Helen Roemer, US

Its give big help to me

Jennifer Santos, US

It has been easy.

Robert Conn, US

Massachusetts Debt Relief

Debt relief most often refers to debt settlement, which is when you negotiate with your creditors to get rid of your debt for less than you owe. Hiring a professional debt relief company to negotiate a debt settlement on your behalf is one strategy for managing your debt in Massachusetts.

The typical person seeking debt relief in Massachusetts is overwhelmed by credit card debt. They owe almost $17,500 across eight credit cards and are getting dangerously close to maxing them out with an average utilization rate of 71%. They're also falling behind on that debt—more than a third of their credit card debt is already past due.

If this sounds a lot like you, then you may want to reach out to Freedom Debt Relief to speak with a debt expert. They've helped thousands of Massachusetts debt relief seekers save money on their debt.

Massachusetts debt relief seekers enrolled an average of $27,243 in debt with Freedom Debt Relief in 2020. Their monthly payments into the program averaged $445, much less than the average $1,572 in debt payments they reported making when they joined.

Is Debt Consolidation the Best Debt Solution?

Let's say you've kept up with your monthly payments, but feel overwhelmed by how much debt you have, or you’re concerned about how much you'll spend on interest by the time your debt is paid off.

Debt consolidation could be a perfect fit for your situation. Debt consolidation involves taking out a new loan and using the funds to pay off multiple existing debts. It works best when you can qualify for a lower interest rate than you're currently paying.

Consolidation isn't as effective a tool if you can't qualify for a lower interest rate. And it doesn’t make sense to consolidate to a loan with a higher rate.

Other Debt Relief Alternatives in Massachusetts

Consolidation and debt settlement aren't the only options for Massachusetts residents dealing with debt. Consider these alternatives:

DIY repayment: Sometimes you just need to get organized. A DIY debt repayment strategy helps you organize and prioritize debts. The debt snowball method has you pay off your debts in order of size, smallest to largest. It could help you stay motivated. The debt avalanche method prioritizes your debt by interest rate, highest to lowest. It could help you save money on interest. In either case, you’ll make minimum payments on all your debts while focusing extra money toward the lowest balance or highest rate.

Hardship programs: Credit card companies and other creditors sometimes offer debt hardship programs. They're designed to provide temporary relief when facing financial hardship like job loss, reduced hours, or a medical emergency. Companies offer relief in various ways, including lowering your interest rate, reducing monthly payments, waiving fees, or pausing payments for a time.

Income-driven repayment plans: Income-driven repayment (IDR) plans are typically associated with federal student loans. IDR plans cap your payments to a portion of your discretionary income. If you qualify and after you make all your scheduled payments, any remaining balance is forgiven.

Credit counseling: Credit counseling agencies could help you set up a debt management plan (DMP), which is a structured debt repayment plan (with no debt forgiveness). They may also negotiate with your creditors to reduce your interest rate or get fees waived. A DMP typically takes three to five years to complete.

Bankruptcy: Bankruptcy is a legal procedure for dealing with debt. Depending on the type of bankruptcy filed, the bankruptcy court may discharge (forgive) some or all debts. While bankruptcy remains on your credit report for seven to 10 years, it's possible to begin rebuilding credit almost immediately.

If you’re in Massachusetts and not sure about the next steps for dealing with your debt, call Freedom Debt Relief at 800-910-0065. A Debt Consultant will speak to you about your financial situation and goals, and then come up with a debt relief plan that works with your income and expenses.

Bay Staters can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

What is debt consolidation and how does it work in Massachusetts?

Debt consolidation is when you use a new loan to pay off multiple smaller loans. The idea is to simplify your payments and, ideally, to reduce your overall interest rate. Debt consolidation generally works the same in Massachusetts as in other states, though there may be state regulations that cap interest rates on certain types of loan products.

Here's how debt consolidation typically works:

Apply for a debt consolidation loan. Look for a loan large enough to cover the debts you want to consolidate with terms you can afford. If possible, get a loan with a lower interest rate than you're currently paying on average. This could reduce your monthly payment.

If approved, receive the loan funds as a lump sum in your bank account.

Use the funds to pay off your other debts.

Start making payments on your consolidation loan. You now have one set monthly payment instead of several payments that may vary from month to month.

What different types of debt consolidation options are available in Massachusetts?

Generally, most Massachusetts residents have three options for consolidating debt:

Personal consolidation loans. A personal loan is typically an unsecured installment loan that you may use for a variety of things, including consolidating debt. It doesn't require any kind of collateral (something you own of value that backs up the loan). Personal loans usually have lower interest rates than credit cards, so they could be good for consolidating high-interest credit card debt.

Balance transfer credit cards. A balance transfer is when you move debt from one credit card to another credit card. You might do this if you qualify for a credit card with a 0% APR balance transfer offer for 12+ months of no interest on transferred balances. The catch is that they often charge a 3% to 5% balance transfer fee. Also, any balance left over when the offer ends will start to accrue interest at the go-to APR—which will be high.

Home equity loan or home equity line of credit (HELOC). If your home is worth more than you owe, that value is called equity. You could potentially use that equity as collateral for a home equity loan or HELOC. Also called a second mortgage, a home equity loan is also secured by your property. Secured loans tend to have lower interest rates, but you risk losing your collateral if you can't repay.

What are the credit score requirements for debt consolidation loans in Massachusetts?

The requirements for a debt consolidation loan in Massachusetts will vary based on the lender and the type of loan. Here are some general guidelines:

Home equity loans or lines of credit: These loans are secured by your property, which makes them less risky for the lender. This often means lower credit score requirements and you could potentially get a home equity loan with a credit score in the 600+ range. The size of the loan will depend mostly on how much equity you have in your home. Equity is what your home is worth minus how much you owe on your mortgage.

Personal loans: Unsecured loans tend to have higher credit score requirements than secured loans because they're seen as riskier for the lender. Personal loan lenders generally like to see scores in the mid to upper 600's. Your credit score will also impact the size and interest rate of your personal loan, with higher scores typically getting larger loans with lower rates.

How to find reputable debt consolidation companies and services in Massachusetts?

You can find reputable debt consolidation companies in Massachusetts in a few ways:

Recommendations. Ask your friends and family if they used a specific lender or service for debt consolidation and if they were happy with the results. You could also ask your social media friends for online lenders or services that may operate in your area.

Research online. Start with a web search to put together a list, then check review sites for user feedback and information about the company's reputation.

Your local bank or credit union. If you're already happy with your current bank, you can look into their consolidation loans. Local credit unions can also be good places to find competitive interest rates.

Once you choose a company, be sure to contact them to ask about the services you want. A reputable debt consolidation company should be willing to answer any questions and should be transparent about its services and fees.

What are average interest rates for debt consolidation loans Massachusetts October 2025?

In October 2025, the average interest rate on a two-year personal loan was 11.14% according to the Federal Reserve Bank of St. Louis. However, personal loan rates can vary significantly depending on your credit history. Typical personal loan interest rates range from 6% up to 36%.

The lowest interest rates are generally offered to borrowers with the highest credit scores. Sources for online loans estimate that borrowers with fair credit scores—FICO Scores of 580 to 669—received average rates in the 18% to 30% range. Borrowers with good credit, or scores of 670 to 739, had average interest rates between 14.5% and 22%.

Lenders will look at your entire credit history, not just your credit score, when considering your application. Your income, current debts, and previous relationship with the lender may also play a role in whether you get approved and what rate you receive if you get a loan offer.

What are Massachusetts state laws and consumer protections for debt consolidation?

Massachusetts has several state laws that deal with rules around lending, including consolidation loans. Of note, state law technically caps the interest rate on loans at 6% unless a higher rate is agreed to in a written contract. Since most loans require a contract, it's simple for consumers and lenders to bypass this law.

Massachusetts has a usury law that caps the interest rate for most personal loans under $6,000 at 20%. However, exceptions are made if the lender has a special license. Additionally, banks, credit unions, and other financial entities may not be subject to Massachusetts loan rate caps if they are instead subject to the laws of another state or to federal laws.

Massachusetts requires lenders to be licensed by the Division of Banks to operate in the state. They're also required to clearly disclose all loan terms, including the interest rate and any other fees.

What are the benefits of consolidating credit card debt in Massachusetts?

The benefits of consolidating your debt will depend a lot on your situation. They could include:

Simplified debt. If you're currently struggling to keep track of multiple debt payments, consolidation could simplify your finances. For example, consolidating multiple credit cards with one personal loan would give you one predictable monthly payment instead of several minimum payments that can vary.

Lower monthly payment. Consolidation could result in a lower monthly debt payment if you reduce your average interest rate and/or choose a longer loan term. A lower interest rate means you pay less in interest fees. Your loan term is how long it takes to repay your loan; a longer term can mean a lower monthly payment, but you may pay more in interest overall.

Lower revolving utilization rate. Reducing your utilization rate—how much of your revolving credit you're using—could improve your credit scores. If you consolidate credit card debt with a loan, you turn revolving debt into installment debt. This may reduce your revolving utilization and could improve your credit score.

What are the potential risks and drawbacks of debt consolidation in Massachusetts?

Consolidating debt has a few potential drawbacks, including:

Consolidation isn't free. Getting a consolidation loan will likely cost money no matter which strategy you choose. Crunch the numbers to see if the benefits outweigh the cost before you get a new loan or credit line.

You may not reduce your interest rate. Personal loans often have lower rates than credit cards, but there is no guarantee; your rate will depend largely on your credit history and other factors.

You could wind up with more debt. If you consolidate your credit cards with a loan and then keep using your cards, you could wind up with more credit card debt on top of your installment loan. Consolidation works best when you stop taking on more debt.

Secured consolidation loans could put your home at risk. If you consolidate with a home equity loan or credit line, your property is the security for that loan. If you stop making payments, the lender could foreclose on your home.

How to choose the best debt consolidation method in Massachusetts for my situation?

The first step to choosing a debt consolidation method is to review your options. This could include a personal loan, a home equity loan or line of credit, or a balance transfer credit card.

One way to choose the best strategy is to crunch the numbers using an online calculator to compare the costs. Look at both the monthly payment as well as how much interest you'll pay overall to get a good idea of the total cost.

You may also want to make a list of the pros and cons for each method for you personally. For example, while a home equity loan could give you a lower rate, you may not be comfortable using your home as collateral (something of value that secures a loan) since it could be at risk if you can't repay your loan.

Once you've looked at the costs and evaluated the pros and cons, you should have a much better idea of the best option for you. If you're still stumped, talk to a debt expert who can help you choose.

What are debt management plans vs debt consolidation loans in Massachusetts?

A debt management plan, or DMP, is a structured debt repayment plan offered by credit counseling agencies. A debt consolidation loan is a new loan you use to pay off multiple debts with the goal of simplifying your finances and getting a lower interest rate.

In a DMP, a credit counselor attempts to negotiate with your creditors to reduce your interest rate and/or get fees waived. Then, you'll make a set monthly payment to the credit counseling agency each month and the agency pays your creditors. DMPs typically take three to five years to complete.

Consolidating your debts with a loan could reduce the total number of debt payments you make each month. It may also reduce the cost of your debt if you qualify for a lower interest rate. The time it takes to pay off your consolidation loan will depend on the terms of your loan. Personal loans typically have a term length of two to seven years.

End Your Debt

Find out how our program could help.

- One low monthly program deposit

- Settlements for less than owed

- Debt could be resolved in 24-48 months