Maryland Debt Relief By the Numbers: 5-Year Debt Trends

Maryland has one of the highest average salaries in the U.S., with the average resident taking home more than $73,000. You might think that most people in the state would be sitting pretty, but there are plenty of Marylanders struggling with debt right now.

The typical Maryland debt relief seeker owes $32,667. This is well above the $26,573 average for debt relief seekers across the nation. That said, Maryland residents looking to put their debt behind them have a lot of solid options to consider, including debt settlement. Here's what you need to know if you're among them.

Marylanders can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

5-Year Debt Trends in Maryland

Maryland debt has risen faster than the national average over the last five years. In 2020, the average debt relief seeker nationwide owed $25,939 while the Maryland average was $24,658. Debt burdens for both groups have risen since the start of the decade, but while the national average ticked up to $26,573 in 2024, Maryland debt relief seekers found themselves struggling with $32,667 in debt on average.

This could be partially due to the fact that credit card utilization—the amount of your available credit that you use each month—has risen among those seeking help with their debts during this time. Utilization averaged 68.1% for Maryland residents in 2020 and 76.4% in 2024. In the short term, credit cards can help people cover expenses. But over time, the high interest rates on credit card debt increase the likelihood that these borrowers will fall behind on payments, incur late fees, or have their accounts sent to a collections agency.

Here's a closer look at how Marylanders have fared with some of the most common types of debt.

Maryland credit card debt

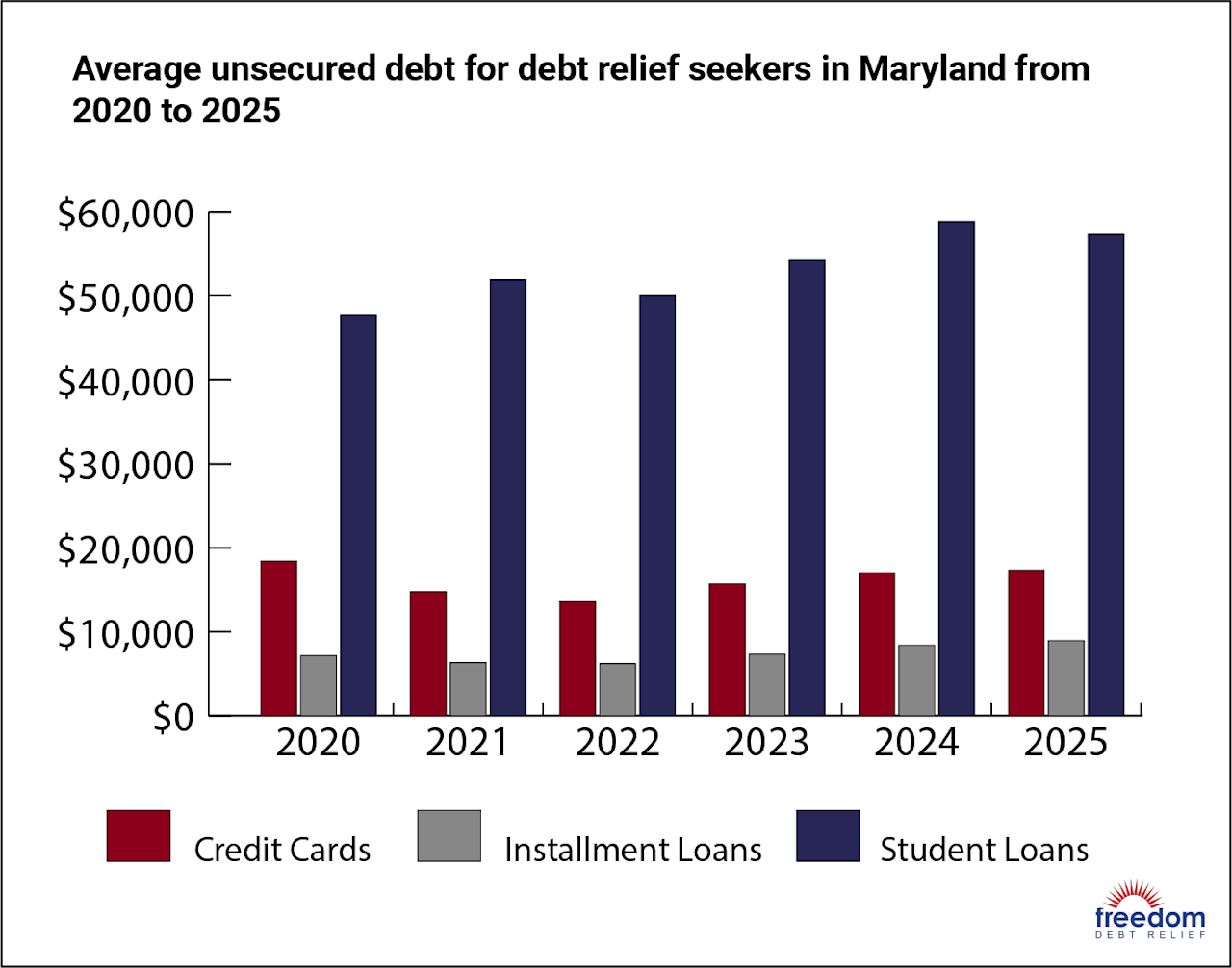

The pandemic payoff was a real thing. Maryland debt relief seekers saw their credit card balances drop from a high of $18,441 in 2020 to just $13,618 in 2022. But since then, the number has been creeping back up. By 2024, it exceeded $17,000. The national average among debt relief seekers in 2024 was just $15,636.

Credit card utilization has risen as well. Debt relief seekers in Maryland now use 76.4% of their available credit. This is a little higher than the 75.7% average among those seeking debt relief across the nation.

Given all this, it's unsurprising that past-due amounts in Maryland and the nation have also slowly crept up over the last couple of years. Among debt relief seekers, the national average sits at $5,793 for the first half of 2025 while the typical Maryland resident pursuing debt relief is behind on $6,069 in credit card payments.

Part of this has to do with the low monthly payments most credit cards require. In Maryland and the nation as a whole, most people have seven or eight credit cards and only pay about $500 per month toward the balances. This, coupled with the high interest rates, can leave you needing credit card debt relief options after a while.

Maryland auto loan debt

Car loan balances and monthly payments have risen pretty steadily across the nation over the last five years. In 2020, the typical debt relief seeker was making $594 payments on a $22,534 balance.

By 2024, Maryland drivers seeking debt relief faced an average monthly auto loan payment of $731 per month with an outstanding balance of $27,663. This is pretty close to the average among debt relief seekers nationwide of $726 monthly payments on a $26,839 auto loan.

Maryland mortgage debt

Mortgages are most people's biggest debts, and Maryland is no exception. The typical debt relief seeker in the state is trying to pay off an average $292,498 loan and make $2,206 monthly payments while juggling their other bills.

These figures are quite a bit higher than the average for debt relief seekers nationwide, which is largely due to the fact that Maryland has high housing costs compared to most of the rest of the country. The typical American homeowner seeking debt relief still faces a significant challenge, though, with an average balance of $241,535 and a monthly payment of $1,949.

Maryland installment loan debt

Installment loans, like personal loans, are one area where Maryland debt relief seekers fare better than debt relief seekers in other states. The typical American seeking help for installment loan debt has about three loans with a total monthly payment of $436 and a combined balance of $10,582.

Maryland borrowers appear slightly less likely to take out installment loans. Debt relief seekers from the state average just 2.7 installment loans with a monthly payment of $383 and a balance of $3,893.

Low-income Marylanders and those with low FICO Scores are more likely to take out these types of loans. However, their balances tend to be smaller than debt relief seekers who have good credit scores and higher incomes.

Maryland student loan debt

The average Maryland debt relief seeker is juggling about five student loans with a total monthly payment of $331 and an overall balance of $58,801. These numbers have risen drastically over the last five years. Back in 2020, Maryland residents seeking debt relief had just four student loans with an overall balance of $47,767.

These numbers are also higher than the national average. The typical American seeking help with their student loan debt owes $49,861 and has monthly payments of about $298. Student loans can be difficult for any young graduate to accommodate in their monthly budget.

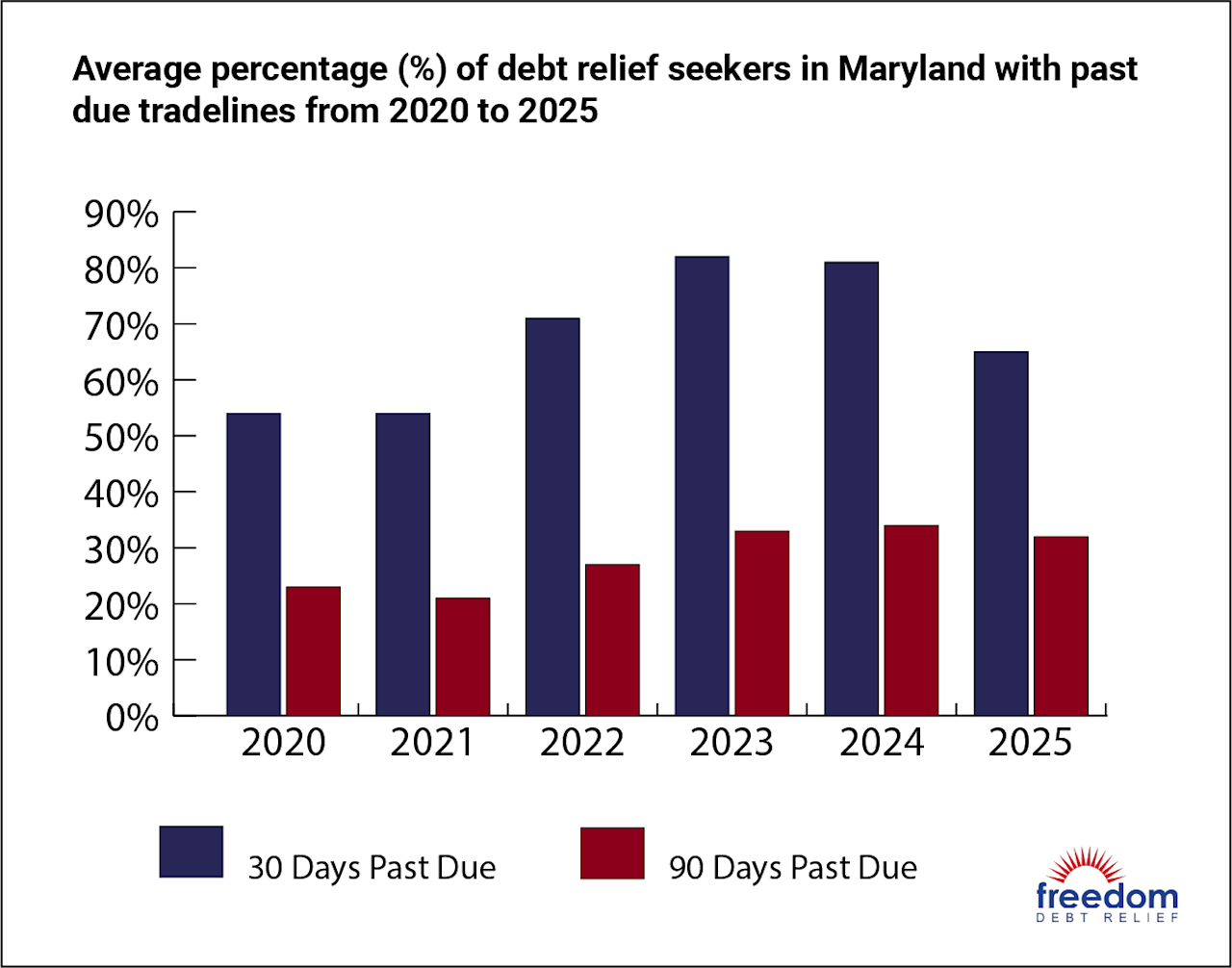

Maryland Debt Delinquencies and Collections

Maryland borrowers who fall behind on their payments could find their accounts handed over to a collections agency. This can often be what pushes them to seek out debt relief. The typical collection balance of these Maryland debt relief seekers is $3,189 spread across 1.8 loans. This is almost exactly in line with debt relief seekers nationwide.

However, creditors usually won't report you to a collections agency until you're several months behind on payments. This happens less than you might expect (and you don’t have to be seriously delinquent before you can explore debt relief). Of the Maryland residents who sought help for their debts, only 0.8% had debts that were 30 days past due. Just 0.3% had debts 90 days or more past-due. This is right on track with the national average among debt relief seekers.

Those with lower incomes (less than $40,000 per year) were the most likely to see their accounts go to collections. They owed $3,183 on average to collections agencies compared to just $1,712 for those earning $200,000 or more. When you have fewer resources, it’s easier to fall into a debt hole.

Average collections account balances continue to rise for all Maryland debt relief seekers, even as the number of collections accounts they face declines. This suggests that these borrowers may be seeking fewer, but more expensive loans.

Maryland Statute of Limitations

The statute of limitations is the amount of time a creditor has to sue you for an unpaid debt. After the statute of limitations expires, the creditor cannot get a legal judgment against you for the debt, though that doesn't mean they'll stop asking you to.

Every state sets their own rules. Here's a closer look at the Maryland statute of limitations:

| Type of Debt | Statute of Limitations |

|---|---|

| Debt for the sale of goods | 4 years |

| Other debts | 3 years |

You should note that if a creditor obtains a judgment against you—that is, a court says you have to pay the creditor what you owe—the creditor has 12 years to enforce that debt.

What are the Maryland debt collection laws?

Maryland residents are protected by federal laws as well as the Maryland Consumer Debt Collection Act. Under this law, debt collectors can't:

Use or threaten force or violence

Threaten criminal prosecution unless you've violated a criminal law

Disclose or threaten to disclose false information that could affect your creditworthiness

Contact your employer about your debts before obtaining a final judgment

Disclose or threaten to disclose information affecting your reputation to anyone other than a spouse (or parent, if the borrower is a minor) who doesn't need to know it

Contact you at unusual hours, too often, or in a harassing way

Use bad language when communicating with you

Claim, attempt, or threaten to enforce a right that doesn't exist

Give the appearance of being a lawyer or part of a government agency when they are not

If a debt collector violates these rules, you can contact the Maryland Attorney General's Consumer Protection Division or submit a complaint to the Maryland Department of Labor. You may want to reach out to the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) as well.

Reviews and Testimonials from Maryland

Working with me and always have a solution while I’m not employed! The phone calls are pleasant and the reps make me feel like i matter

Jeanette Russ, US

Freedom Debt is reducing the balances of my credit card debt payment just about half from what I really owe.

Victor Monge, US

Great communication. Very helpful

Jacklyn Charest, US

Maryland Debt Relief

Debt relief, also known as debt settlement, is a process that can help you get rid of your unsecured debts for less than what you owe. It could make sense for you if you don't believe you'll be able to keep up with your payments any other way. You can do this on your own or by working with a professional debt relief company, like Freedom Debt Relief.

To settle debts, you need money to offer your creditors. Most people find it difficult to pay their bills while saving up money for debt settlement, so they choose to stop making their debt payments. To be clear, if you don’t pay your bills, your accounts could go into collections or even lead to a debt lawsuit. There are financial consequences such as late fees and additional interest. And your credit standing is likely to take a hit.

Many people who begin a debt settlement program are already falling behind on their bills. If that’s the case, the credit score damage might be lighter than it would be if you haven’t made any payments yet.

You don’t have to stop paying your bills, but doing so sends a strong message to your creditors that you’re in financial distress. After all, they may be less likely to offer partial debt forgiveness to someone who can afford to continue making minimum payments indefinitely.

If you’re in a debt settlement program, you’ll deposit money every month into an account that’s set up for building up funds for settling debts. You own and control the account. When you've saved enough, Freedom Debt Relief will make your creditor an offer. If your creditor accepts, the agreement will be presented to you for your approval. Once you approve the agreement, your creditor is paid from your dedicated account. Once all agreed-upon payments are made, you'll be off the hook for the remainder of your debt.

Most clients settle their first debt within a few months. Total time to completion varies, depending on who and how much you owe and how much you can set aside per month. The typical Maryland debt relief seeker comes to the program with about $26,644 in debt and pays about $446 into their program account each month. Most finish in two to four years.

You can contact Freedom Debt Relief for a free consultation to see if it's the right path for you. A debt consultant will listen to your situation without judgment and help you come up with a game plan to put your debt behind you.

Is Debt Consolidation the Best Debt Solution?

Debt consolidation is a path forward if you can afford to repay your debts and you qualify for a new loan with better terms. Debt consolidation is where you take out a new loan, ideally with a lower interest rate, to pay off your existing debts. This could be a smart strategy if you have a good or excellent credit score or if interest rates have dropped significantly since you took out your existing loans.

Other debt relief strategies you can try include:

DIY debt payoff: Make the minimum payments on all of your credit cards each month. Then, put any extra cash you have toward either the card with the lowest balance or the card with the highest interest rate. Once it’s paid off, focus on the next card in line.

Debt management plan: Credit counselors can help you set up a debt management plan and may be able to negotiate lower rates or fees with your creditors. You make payments to the credit counselor and they distribute the money to your creditors. The monthly payments in a DMP are sometimes too high to keep up with.

Bankruptcy: Bankruptcy is legal protection from your creditors. It’s the only way to temporarily halt collections, including mortgage foreclosure. Chapter 7 bankruptcy could erase your unsecured debts within a few months, but you may have to give up some of your possessions. Chapter 13 bankruptcy is a three- or five-year payment plan for those whose incomes are too high for Chapter 7 bankruptcy.

Marylanders can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

Does Maryland have a debt relief program?

Maryland doesn't have its own debt relief program. However, there are options available to all Americans that Maryland residents can use to get a handle on their debts. These include debt settlement, debt consolidation, and bankruptcy.

Is Maryland debt relief legitimate?

Yes. Many debt relief strategies in Maryland are legitimate, including debt settlement and debt consolidation. That said, there are also scammers looking to profit off of your difficult situation. Always research the company you plan to work with before handing over any personal information.

Is there really a debt relief program from the government?

Yes, but for credit card debt, the only government program would be bankruptcy, if you qualify. The government offers debt relief for certain types of debt, like student loan forgiveness programs and IRS tax debt settlement programs. However, the government doesn't have a general-purpose debt relief program that you can use with any type of debt.

End Your Debt

Find out how our program could help.

- One low monthly program deposit

- Settlements for less than owed

- Debt could be resolved in 24-48 months