Indiana Debt Relief By the Numbers: 5-Year Debt Trends

Debt is a serious issue throughout the U.S., but debt levels are lower in Indiana. The average Indiana resident had $48,000 in debt in 2024, according to the Federal Reserve Bank of New York. That’s $13,600 less than the average for the country as a whole.

Unfortunately, there are still plenty of Indiana residents struggling to make their debt payments. Data from Freedom Debt Relief shows that a growing number of consumers in the Hoosier State have looked into debt relief over the last five years.

These debt relief seekers carried an average of $69,952 in unsecured debt and $190,165 in secured debt during the first half of 2025. In addition, FICO Scores tend to be a bit lower in Indiana than nationwide. A lower credit score makes some debt repayment strategies, such as debt consolidation, more difficult.

Hoosiers can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

5-Year Debt Trends in Indiana

Personal debt in Indiana has gone up and down since the start of the decade. Debt relief seekers had an average of $67,540 in unsecured debt in 2020. The average dropped as low as $58,907 in 2022, before rebounding to $68,036 in 2024. Unsecured debt is any debt without collateral attached, including credit card debt and personal loans.

U.S. debt relief seekers overall went from average unsecured debt of $69,323 in 2020 to $76,079 in 2024, a 10% increase. Indiana’s minimal debt growth looks impressive in comparison.

Where Indiana has seen more growth is secured debt, including mortgages and auto loans. Debt relief seekers in the state had an average secured debt of $144,276 in 2020, and $190,165 in 2024. Secured debt normally isn’t as problematic, since there are assets attached. However, it can become an issue if you can’t keep up with your payments.

For the average Indiana resident looking into debt relief, debt payments cost an average of $1,463 per month in 2024. And for debt relief seekers with accounts in collections, the average collections balance was $2,728 in 2024.

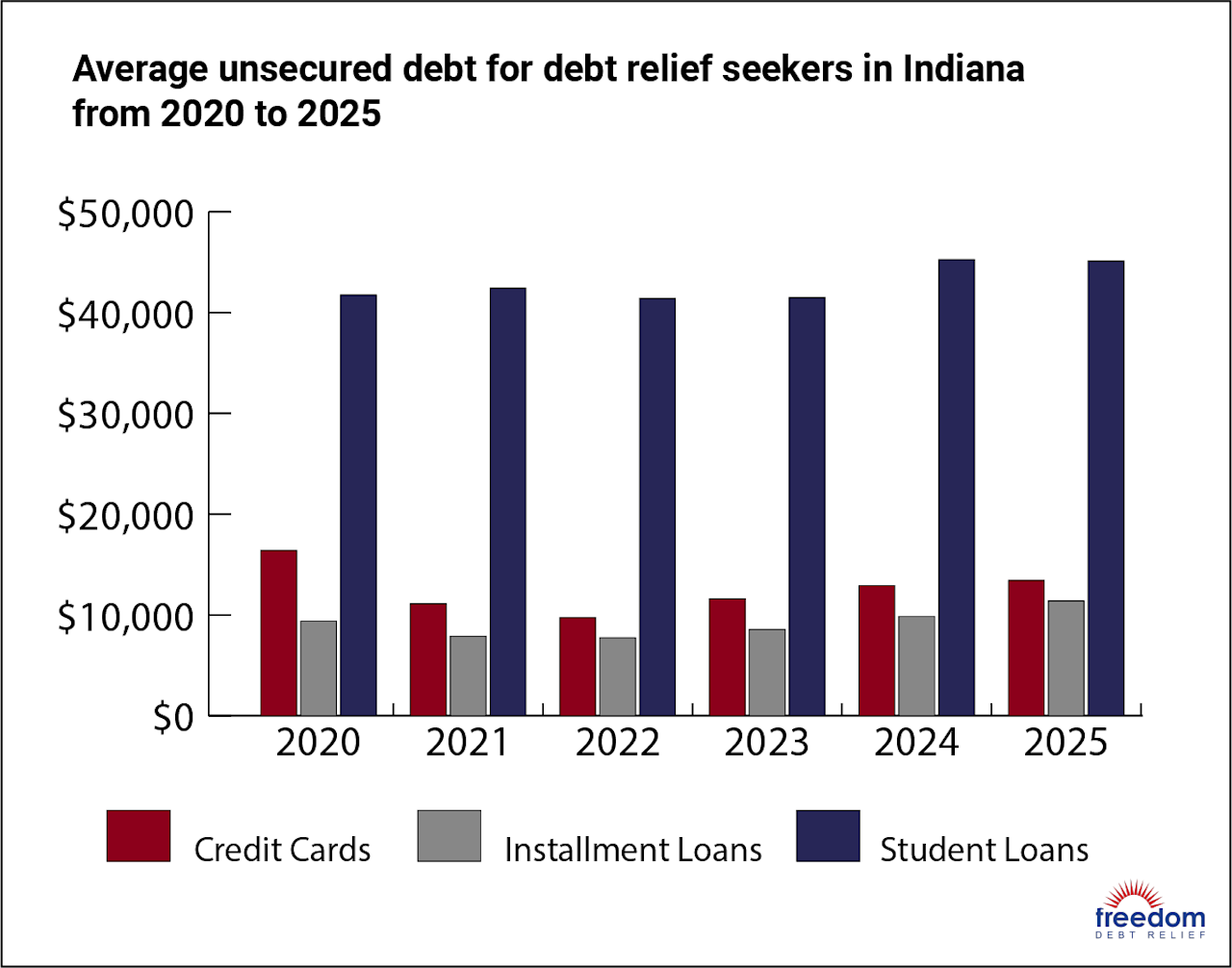

Indiana credit card debt

Debt relief seekers in Indiana had an average of $12,917 in credit card debt with a $428 monthly payment in 2024. Nationally, those looking into debt relief carried an average credit card balance of $15,636 in 2024, so Indiana residents do better than average. But according to Experian, the average FICO Score in Indiana was 712 in 2024, a little below the U.S. average of 715.

The big danger with credit cards is that it’s easy to get in over your head, and that can happen anywhere. Indiana debt relief seekers had an average of 7.2 credit cards and $4,699 in past-due balances in 2024, along with an average FICO Score of 574. Certain groups, especially people with low incomes or credit in the “poor” range (below 580), were particularly vulnerable.

Indiana debt relief seekers with poor credit had an average credit utilization of 95.3%. That means their credit card balances exceeded 95% of their credit limits. Indiana debt relief seekers with low incomes were in a similar position, with average credit utilization of 91.5%. If you’re maxing out or close to maxing out your credit cards, you may want to look into how to get credit card debt relief.

Indiana auto loan debt

Debt relief seekers in Indiana had an average car payment of $665 on an average auto loan balance of $24,399 in 2024. Although those numbers are below the national averages for the same period, they’re a solid uptick from 2020, when the average payment was $538 on a $20,509 auto loan balance.

Income is one of the main factors in how much people spend on their vehicles. Indiana’s low-income debt relief seekers had an average auto loan balance of $14,180 in 2024, compared to $74,240 for high-income debt relief seekers.

Indiana mortgage debt

Affordable housing is one of the perks of living in Indiana—housing costs are much lower than the national average. The median mortgage payment in Indiana is $1,466, compared to $2,035 for the U.S. as a whole, according to the U.S. Census Bureau.

Indiana debt relief seekers pay an average of $1,341 per month on their mortgages, with an average mortgage balance of $165,189, as of 2024. The average mortgage balance for debt relief seekers nationwide in 2024 was $241,535, a difference of over $75,000.

Indiana installment loan debt

Indiana residents looking for debt relief had an average of $9,861 in installment loan debt in 2024, with a monthly payment of $392. Both figures came in below the national averages among debt relief seekers: $10,582 in installment loan debt with a $436 monthly payment.

But this type of debt has increased quite a bit recently. In Indiana, the average personal loan balance for debt relief seekers went up to $11,407 with an average monthly payment of $451 in the first half of 2025. Borrowing more money could be a sign people are having trouble making ends meet.

Indiana student loan debt

Student loan debt is less of a burden in Indiana than it is nationwide, in part because college is more affordable. The total cost of a four-year public university in Indiana is 9% cheaper than the U.S. average, according to the Education Data Initiative. Indiana debt relief seekers had an average of $45,258 in student loan balances in 2024, compared to $49,861 in the U.S. as a whole at that time.

The typical payments on this type of debt are relatively low. Debt relief seekers in Indiana had to pay an average of $284 per month toward their student loans in 2024. Low monthly payments can be a double-edged sword. They don’t take as much out of your budget, but if you only pay the minimum due, you could make very slow progress paying down your student loan debt.

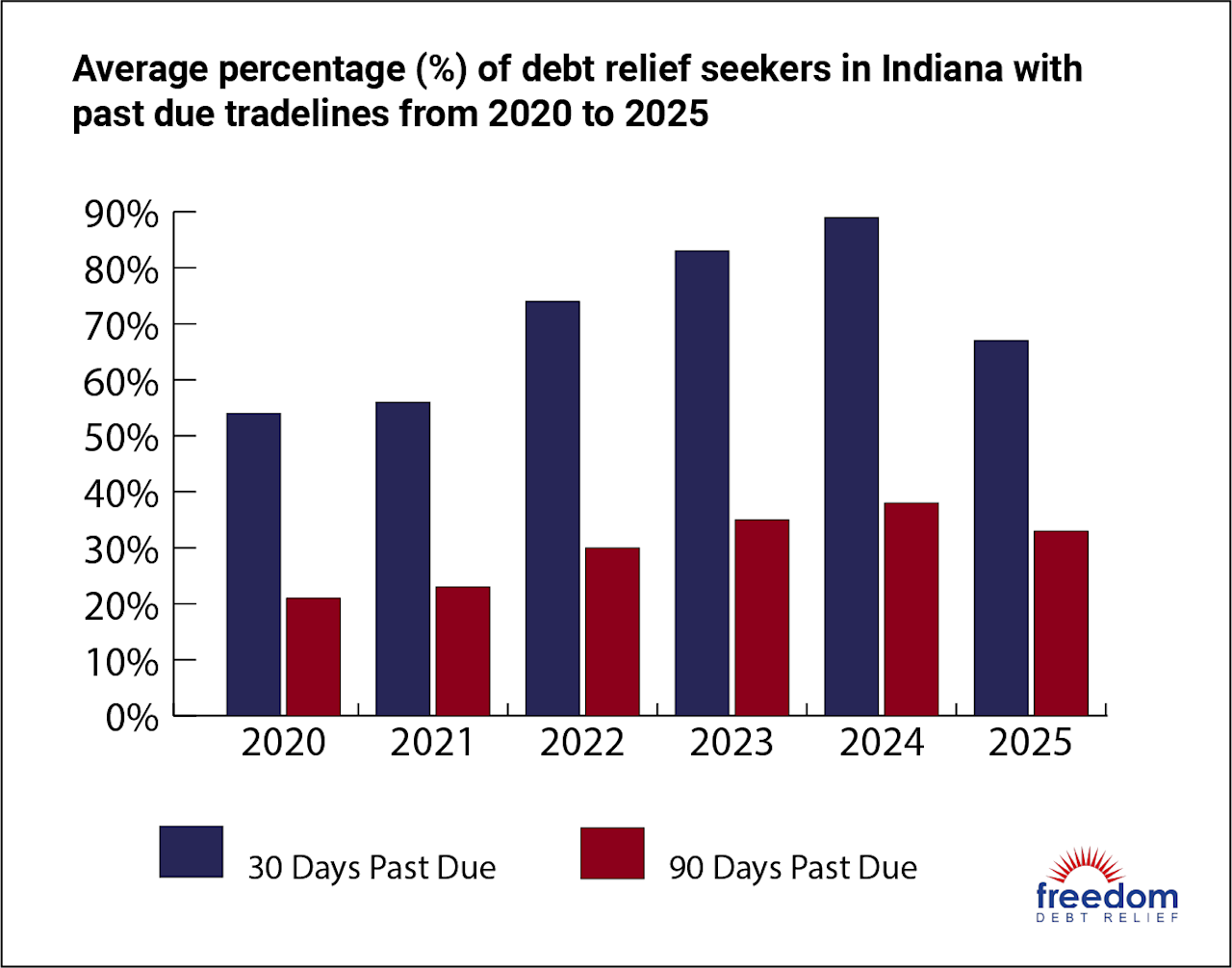

Indiana Debt Delinquencies and Collections

Debt delinquency rates in Indiana are close to the national rates, according to TransUnion data from September 2025. For auto loans, 4.14% are at least 30 days past due (DPD), a little better than the national average of 4.34%. Indiana’s delinquency rate for bankcards (credit cards) is 4.76% (30-plus DPD), slightly behind the national rate of 4.66%. Where Indiana does the worst is mortgages, with 3.21% being 30-plus DPD, compared to the national average of 2.89%.

The table below provides delinquency rates for Indiana auto loans, credit cards, and mortgages, with the percentage that are at least 30, 60, and 90 DPD.

| Type of debt | 30-plus DPD | 60-plus DPD | 90-plus DPD |

|---|---|---|---|

| Auto loan | 4.14% | 1.60% | N/A |

| Credit card | 4.76% | 3.36% | 2.43% |

| Mortgage | 3.21% | 1.45% | 0.91% |

Indiana residents looking into debt relief often already have collection accounts, but collection balances have been decreasing. The average collections balance (among debt relief seekers with collection accounts) went from $3,645 in 2020 to $2,728 in 2024, and it dropped even more—to $2,465—in the first half of 2025.

A similar trend has happened in the U.S. as a whole. Among people looking for debt relief with accounts in collections, the average collections balance fell from $3,815 in 2020 to $3,183 in 2024.

Indiana Statute of Limitations

The statute of limitations for debt in Indiana determines how much time creditors and debt collectors have to sue you over a delinquent debt and hope to win a judgment. Once an account is past the statute of limitations, it’s considered “time-barred” debt, and you’re not legally responsible for it anymore, even if a creditor or collector tries to sue.

Each state has its own statute of limitations on debt. The type of debt also factors into the statute of limitations. The table below shows the Indiana statute of limitations for different types of debt.

| Type of debt contract | Indiana statute of limitations |

|---|---|

| Written contracts | 10 years |

| Oral contracts | 6 years |

| Promissory notes | 6 years |

| Open-ended accounts (such as credit cards) | 6 years |

What are the Indiana debt collection laws?

Indiana debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). The FDCPA is a federal law designed to prevent abusive, deceptive, and unfair debt collection practices. Here are the guidelines set by the FDCPA that debt collectors must follow:

Debt collectors can’t contact you at an unusual time or place, or a time or place they know is inconvenient for you. They’re generally prohibited from calling before 8 a.m. or after 9 p.m.

Debt collectors can’t publicly post on social media about a debt they claim you owe. They can use social media to contact you privately, unless you request that they don’t contact you like this.

Debt collectors can’t harass you, threaten you, lie to you, or contact you excessively.

If a debt collector knows you have an attorney, they must stop contacting you and contact your attorney instead.

Reviews and Testimonials from Indiana

They were detailed about the process, concerned about their client satisfaction and convenience and most importantly, helping their client with financial stability.

Olalekan Adeleke, US

Best and easyest way to pay your debt

Jonathan Cruz Morales, US

Freedom Debt relief is amazing. I had 80 grand of debt that was charged off and a law suit against me. They were able to help me get the law suit dropped and negotiated my debt way down because of them I’m okay now. I got most of all My debts negotiated to way less than what they were when I enrolled. I’m now free from the program and ready to build my new life. Thank you so much team at FDR

Meredith Brown, US

Indiana Debt Relief

If you can’t afford your unsecured debt payments and won’t be able to fully repay your debts, an Indiana debt relief program could be a way out. After you enroll, you make a low monthly deposit into a debt settlement account (owned and controlled by you). The debt relief company handles negotiations with creditors and debt collectors to help you settle your debts.

A debt relief program can help you get rid of debt, potentially in as little as 24 to 48 months.

To get started with an Indiana debt relief program, call Freedom Debt Relief at 800-910-0065. You’ll speak to a Debt Consultant about your current debts and financial goals, and they could make a debt relief plan with you, based on your income and monthly budget.

What is debt consolidation and how does it work in Indiana?

Debt consolidation is when you refinance multiple debts into one new debt. Here’s how debt consolidation works in Indiana:

You get a debt consolidation loan or a balance transfer card. If you’re a homeowner, you could use a home equity loan or home equity line of credit (HELOC) to consolidate debt.

You use your loan or balance transfer card to pay off your existing debt.

Going forward, you only need to make payments on your loan or balance transfer card.

One of the main benefits of debt consolidation is that it cuts down your number of monthly debt payments. With fewer payments, you may find your debt easier to manage. It could also reduce your risk of missed payments and late fees.

In some cases, debt consolidation also results in better terms on your debt. You might be able to get a lower interest rate, a lower monthly payment, or possibly both. Note that using balance transfer cards can be a dicey move, because you have a limited time to take advantage of promotional rates. At that point, the card’s regular interest rate takes over. And credit card rates tend to be much higher than loan interest rates.

What are the eligibility requirements for debt consolidation loans in Indiana?

Eligibility requirements for debt consolidation loans in Indiana typically include:

Proof of income, such as paycheck stubs, a W-2, or your tax return

Proof of identity, such as a driver’s license or state ID

A valid Indiana home address

A credit score that meets the lender’s standards

Exact requirements depend on the lender, especially when it comes to income and credit. For income, lenders generally look at how much you earn, the stability of your income, and your debt-to-income (DTI) ratio. Your DTI ratio is your combined monthly debt payments divided by your monthly income. All these factors impact whether you’re approved for a loan, and the amount you’re approved to borrow.

Lenders also normally check your credit score and your credit history as a whole. There’s no strict minimum credit score, as each lender has its own eligibility requirements. Even if your credit isn’t the best, debt consolidation loans for bad credit in Indiana could still be an option.

Pros and cons of debt consolidation for Indiana residents

Here are the benefits of debt consolidation for Indiana residents:

You could get down to one monthly debt payment. Debt relief seekers in Indiana have an average of seven credit cards, so debt consolidation could be a great way to simplify your finances.

You could secure a lower interest rate. If you have credit card debt or other high interest debt, debt consolidation is often an opportunity to save money.

Debt consolidation could improve your credit. Among the many factors affecting your credit score is your credit mix. It’s normally better to have a variety of credit, such as loans and credit cards, instead of just one or the other. A debt consolidation loan is a way to diversify the types of credit you have.

Here are the drawbacks of debt consolidation in Indiana:

It doesn’t address the root cause of your debt. Debt consolidation is only a way to restructure your debt. You still need to resolve whatever led to debt in the first place.

There are often fees to consolidate debt. Many lenders charge origination fees for debt consolidation loans, and most balance transfer cards have balance transfer fees.

It can be hard to qualify for a new loan with a low credit score or overwhelming debt. In either situation, debt consolidation may be out of reach or only available with unfavorable terms. If so, you could be better off with a debt relief program.

How does debt consolidation affect your credit score in Indiana?

At first, debt consolidation could cause a small decrease in your credit score. When you apply for debt consolidation in Indiana, the lender checks your credit, which creates a hard credit inquiry. Hard inquiries impact your credit, but normally not by much. Most people’s credit scores drop no more than five points after a hard inquiry.

If you make your payments on time every month and use debt consolidation to get rid of credit card debt, a debt consolidation loan could help your credit score over the long haul. Every on-time payment adds to your payment history—the most important factor in your credit score. Your credit utilization, another key part of your credit score, could also decrease as you pay down credit card debt. Lower credit utilization is good for your credit.

What are the steps to consolidate debt in Indiana?

Here are the steps to consolidate debt in Indiana:

Check your credit score. You can do this using a free credit score tool online. Knowing your credit score can help you figure out which debt consolidation options you qualify for.

Decide how you’ll consolidate debt. The most common options are debt consolidation loans, balance transfer cards, and home equity loans or lines of credit (HELOCs).

Compare lenders or balance transfer cards. If you go with a debt consolidation loan, many lenders let you prequalify to see what kind of terms you could get.

Apply for debt consolidation. In most cases, you can apply for debt consolidation in Indiana online.

Use your debt consolidation loan or balance transfer card to pay off your debt. Once your other debts are paid off, you only need to pay your debt consolidation loan or balance transfer card.

Is Debt Consolidation the Best Debt Solution?

Debt consolidation in Indiana could be your best option if you want to have fewer debts to manage. A debt consolidation loan, as the name suggests, allows you to consolidate or combine your debts into one loan. This is a popular choice for many Indiana residents, as it’s easier to keep track of one monthly payment, rather than multiple payments with varying due dates.

A debt consolidation loan should, ideally, have two benefits going for it: a lower interest rate than the rates on your current debts, and predictable monthly payments to the lender. Another benefit of a debt consolidation program is that you have a specific end date. This could help you budget more effectively and motivate you to keep following the payment plan.

The right method to get out of debt depends on your situation. You may also want to consider:

DIY debt payoff: You build and follow your own debt repayment plan. If your debt payments are affordable, DIY debt payoff could be a good choice, and you can do it entirely on your own. Two popular ways of handling it are the debt snowball and debt avalanche, which prioritize debts in different ways to pay them down one by one.

Debt settlement: You ask your creditors and debt collectors to settle your unsecured debts for lower amounts. You could also have a debt relief company negotiate for you. Debt settlement may be the best option if your debts are too much to realistically repay in full.

Debt management plan (DMP): A credit counseling agency contacts your creditors and negotiates a three- to five-year payment plan. You only need to make one monthly payment to your credit counselor going forward, but the payments on DMPs can be expensive.

Bankruptcy: You file for Chapter 7 bankruptcy and liquidate assets, or Chapter 13 bankruptcy and follow a three- to five-year payment plan. After you finish the bankruptcy process, your remaining debt gets discharged.

Best debt relief options in Indiana besides consolidation

If debt consolidation isn’t right for you, here are other Indiana debt relief options:

Debt settlement is an agreement with a creditor or debt collector to settle your unsecured debt for less than what you owe. You can negotiate with creditors and debt collectors on your own, or work with a professional debt settlement company that negotiates for you. Debt settlement is most appropriate if you can’t fully repay your debt.

A debt management plan (DMP) is a service available with nonprofit credit counseling agencies. Your credit counselors work with your creditors to set up a payment plan lasting for three to five years. You make one monthly payment to the credit counseling agency, and the agency distributes the payment to your creditors.

Bankruptcy is a legal process to deal with debt. In Chapter 7 bankruptcy, you’re required to sell certain assets and give the money to your creditors. Then the court discharges (forgives) your remaining debt. Many people who file Chapter 7 don’t own anything that the court wants to take and sell. If you can afford a monthly payment, you’ll be directed to Chapter 13 instead. In Chapter 13 bankruptcy, you follow a three- to five-year payment plan set up by the court. You don’t have to sell your assets. The court discharges your remaining debt after you finish the payment plan.

Are there state-sponsored debt consolidation programs in Indiana?

No. Indiana doesn’t have state-sponsored debt consolidation programs. Indiana residents can consolidate debt on their own with debt consolidation loans from private lenders.

If you’re looking for Indiana debt relief programs, the state has some options for certain types of student loan debt. These programs include the Richard M. Givan Loan Repayment Assistance Program for eligible law graduates, the Indiana State Loan Repayment Program for eligible health professionals, and the J. Terrence and Peggy Cody Loan Repayment Assistance Fund, also for eligible law graduates.

For other types of debt, you can work with a private debt relief company in Indiana. A debt relief program could help you settle debts if debt consolidation isn’t a realistic solution.

Reputable debt consolidation companies in Indiana as of January 2026

Here are reputable debt consolidation companies in Indiana:

Achieve affiliates offer debt consolidation through personal loans and home equity loans.

Upstart offers debt consolidation through personal loans and home equity lines of credit (HELOCs). It also provides auto loan refinancing and other types of consumer loans.

LendingClub offers debt consolidation loans, which it calls “debt paydown loans,” as well as other types of loans for individuals and businesses.

Compare debt consolidation vs. debt management plans Indiana

Debt consolidation and debt management plans (DMPs) are both debt repayment strategies in Indiana. With debt consolidation, you take out a new loan or balance transfer credit card and use it to pay off your existing debt. For a DMP, you work with a credit counseling agency that sets up the payment plan with your creditors.

Both options can get you down to one monthly debt payment. If you consolidate debt, you only need to pay your debt consolidation loan or balance transfer card. If you get a DMP, you make one monthly payment to the credit counseling agency. Other than that, debt consolidation and DMPs have several differences:

You can consolidate debt on your own, but DMPs are only available through credit counseling agencies.

You can keep your credit cards after debt consolidation. DMPs usually require closing your credit cards.

DMPs often have high monthly payments. Payment amounts vary with debt consolidation, but you could get a lower payment if you have good credit.

DMPs generally have more impact on your credit score than debt consolidation.

What are the typical fees for debt consolidation services in Indiana?

Typical fees for debt consolidation services in Indiana include:

Origination fees to get a loan

Interest charges

Late fees if you miss a payment

Prepayment penalties if you pay off your loan early

You don’t necessarily pay all these fees to consolidate debt. Most lenders charge origination fees, often between 1% and 5%, and interest is a standard fee with loans. But late fees are avoidable if you always make your payments on time, and many lenders don’t charge prepayment penalties.

If you consolidate debt with a balance transfer card, you’ll most likely pay a balance transfer fee—usually 3% to 5%. Balance transfer cards also charge interest, but some offer a 0% rate for an introductory period. If you pay off your balance within the 0% period, you should avoid interest charges.

Hoosiers can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

Does Indiana have a debt relief program?

There are many private companies that offer debt relief programs in Indiana, including Freedom Debt Relief. Indiana doesn’t have a state-sponsored debt relief program.

Does debt consolidation hurt your credit?

Debt consolidation can cause a small drop in your credit score. When you apply for a debt consolidation loan, it generally puts a hard inquiry on your credit file. Hard inquiries affect your credit, but the impact is usually only a few points.

However, debt consolidation could also help your credit score if you use a debt consolidation loan to pay off credit card debt. This could improve your credit utilization, an important factor in your credit score.

What’s the worst a debt collector can do?

A debt collector could file a lawsuit and attempt to get a judgment against you. If the debt collector wins the lawsuit, it may be able to garnish your wages or your bank account, or put a lien on your property. Assuming the debt is valid, you’re usually better off keeping the lines of communication open with a debt collector to negotiate a settlement or payment plan and avoid a lawsuit.

End Your Debt

Find out how our program could help.

- One low monthly program deposit

- Settlements for less than owed

- Debt could be resolved in 24-48 months