Alaska Debt Relief by the Numbers: 5-Year Debt Trends

Alaska has the fifth-highest cost of living in the United States, and the Bureau of Economic Analysis reports that Alaskans average total per-person goods and services costs of $62,900 per year. With a median income of $76,918 for single-earners in Alaska, those costs may be affordable for some, but definitely not for all Alaska residents.

Unfortunately, the data is clear that many Alaskans are struggling. In 2024, the average Alaskan owed $68,900—around $7,300 more debt per person than the average American. The Alaska Beacon also reported that while fewer Alaskans faced collection activities during the COVID-19 pandemic, those numbers have trended sharply upward in the post-pandemic era.

Some of those struggling Alaskans have sought debt relief, and Freedom Debt Relief has collected data on those asking for help. This data provides important, sometimes surprising insight into the financial situations of people dealing with debt.

For example, Freedom Debt Relief's data shows that in 2024, the predicted income among debt relief seekers was $79,687. This shows that even households earning a bit more than the average can experience hardship. Among those seeking debt relief, the typical FICO Score during 2024 was 591, and the debt-to-income ratio averaged 44.7%, which generally falls into the higher-risk category.

Let's delve a little deeper into the details of the financial situation among debt relief seekers to better understand debt trends in Alaska.

Alaskans can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

5-Year Debt Trends in Alaska

In Alaska, debt levels have soared. Estimated debt levels among debt relief seekers in the state did dip slightly during 2021 and 2022, dropping from $25,405 in 2020 to $24,491 in 2021 and $24,091 in 2022. During the period when the government was providing stimulus checks, many people in Alaska and nationwide experienced a boost in their finances.

However, in the post-pandemic era, as inflation has taken hold, debt has risen dramatically. In Alaska in 2023, for example, debt soared to $26,679 among those seeking debt relief. Things grew even worse in 2024, when their average debt level rose to $33,161.

This largely mirrors national trends. Estimated debt among debt relief seekers nationwide fell from $25,939 in 2020 to $21,363 in 2021, and $22,043 in 2022 before rising to $26,573 in 2024.

The credit scores of Alaskans have suffered as their debt levels have climbed, with the average debt relief seeker seeing their FICO Score drop from 614 in 2020 to 591 in 2024. This also mirrors a national pattern, with nationwide FICO Scores among debt relief seekers falling from an average of 608 in 2020 to 581 in 2024.

Surprisingly, though, while Alaskans are struggling with more debt, their collection balances and past-due amounts have fallen. In 2020, the average collection balance among debt relief seekers was $5,712, while it was just $3,037 in 2024. And their past-due amount in 2020 was also much higher at $5,650, compared to $3,008 in 2024.

This may be partially explained by the lingering after-effects of stimulus spending, or by the fact that people are seeking help sooner in Alaska than in the past.

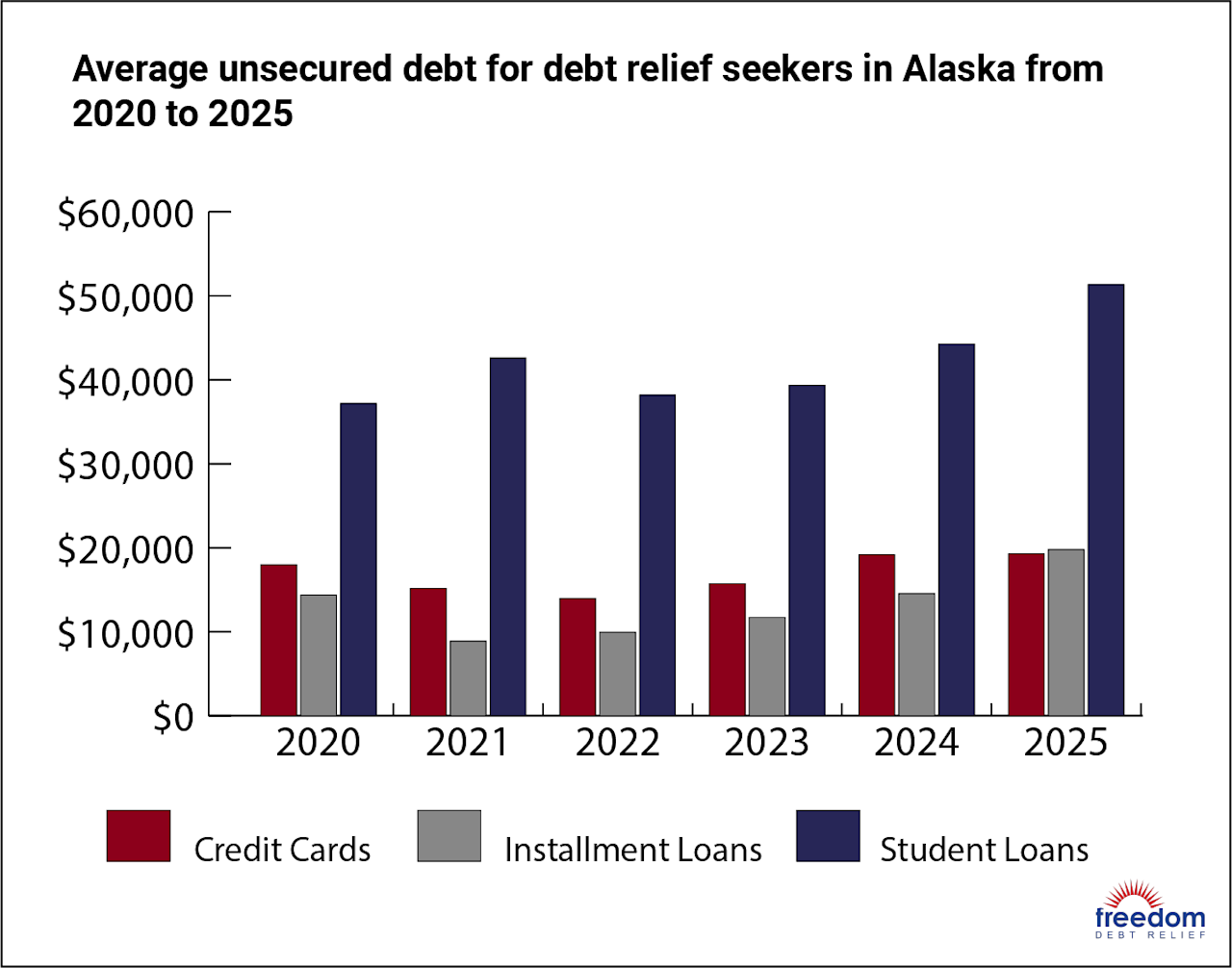

Alaska credit card debt

Credit card balances for Alaskan debt relief seekers follow the same trends as debt among relief seekers overall, with balances falling in 2021 and 2022 before rising in 2023, then jumping sharply in 2024. While their average credit card balance was $17,972 in 2020, it fell to as low as $13,983 in 2022 before climbing to $19,192 in 2024.

This is similar to the national pattern, although on the national level, balances have not grown as much from post-pandemic lows as in Alaska. Nationwide, the average credit card balance among debt relief seekers was $16,553 in 2020, before falling all the way to $12,102 in 2022. It has climbed since, but just to $15,636 in 2024, below what the typical Alaskan debt relief seeker owed.

Alaskans don't just have higher-than-average balances. They also have higher-than average monthly payments, and significantly larger past-due balances than debt relief seekers nationwide. The average past-due credit card amount in Alaska in 2024 among those seeking debt relief was $6,092, compared to $5,240 for the same group nationwide.

Alaskans seeking debt relief have a lot of open credit cards, with an average of 6.8 cards in 2024. Their average credit utilization ratio is also very high at 78.2%, well above the 30% recommended utilization ratio. Unfortunately, using so much available credit can cause significant damage to your FICO Score, because credit utilization is the second most important factor in the credit scoring formula.

Carrying a lot of credit card debt does more than just lower your score. The average credit card interest rate is routinely well above 20%, with those who have lower FICO scores paying higher rates. Paying so much interest makes it hard to pay down what you owe, which is why many people with large balances end up needing credit card debt relief.

Alaska auto loan debt

Alaskans seeking debt relief may also be struggling because of large auto loan balances. The amount that the typical Alaskan debt relief seeker owes on cars has increased over the past five years, and is well above the national average.

The average Alaskan debt relief seeker in 2024 had an auto loan balance of $32,633, compared to the national average of $26,839 among debt relief seekers. This $32,633 balance is significantly higher than the $25,095 owed by the average Alaskan debt relief seeker in 2020. Unsurprisingly, this has resulted in much higher monthly payments, with the average cost per month now coming in at $795 for Alaskan relief seekers in 2024, up from $617 in 2020.

For many people, it's not just one car that costs them. Among debt relief seekers, there are 1.4 auto loans on average.

Alaska mortgage debt

Mortgages are sometimes considered "good" debt, because you use the money to buy an asset that goes up in value. Still, that doesn't mean paying a home loan isn't a burden—particularly when the balance is high. And balances have increased substantially in Alaska, leaving debt relief seekers in the state owing well above the national average.

While the average mortgage balance among Alaskans seeking debt relief in 2020 was just $239,371, that number climbed to $272,276 in 2024. This is over $30,000 more than the average among relief seekers nationwide of $241,535.

Falling behind on mortgage debt can be especially devastating, because it puts you at risk of losing your home to foreclosure. And while you can often settle credit card debt, you typically can’t settle mortgages, since they’re secured debt. Still, lenders usually work with homeowners to enter a payment plan to avoid foreclosure.

Alaska installment loan debt

With installment loans, including personal loans, you have a steady monthly payment and owe a fixed amount. Alaskans seeking debt relief have seen their installment loan balances grow as well in the past four years, jumping from an average of $14,389 in 2020 to $14,544 in 2024.

As with mortgage debt, this is significantly above the average installment loan balance among debt relief seekers nationwide, which was $10,582 in 2024—significantly lower than that of the typical Alaskan looking for help.

Alaskans also face higher-than-average monthly payments on these large loan balances—the average payment among Alaskans seeking debt relief was $530 in 2024, compared to $436 for relief seekers nationwide.

The high balance is surprising, because the average number of installment loans in Alaska is below the national average. Alaskan debt relief seekers had an average of 2.5 installment loans in 2024, compared to 2.9 nationwide. So Alaskans are taking out fewer loans, but borrowing more.

Alaska student loan debt

Student loan debt is a serious issue among people across the United States. Alaskans are not immune, although those seeking debt relief in Alaska have fewer student loans than the nationwide average, as well as lower payments. Debt relief seekers in Alaska had 5.2 open student loans on average in 2024, compared to 5.40 among relief seekers nationwide. Alaskans in need of debt relief reported a student loan balance of $44,255 in 2024, and an average monthly payment of $246, while the nationwide average balance among relief seekers is $49,861 with an average monthly payment of $298.

Student loan rules are likely to change in the coming years, and many legacy income-driven payment plans are already being phased out. Alaskans who owe student loans should check out the new Repayment Assistance Plan, which is set to replace PAYE, REPAYE, and SAVE plans by July 30, 2028.

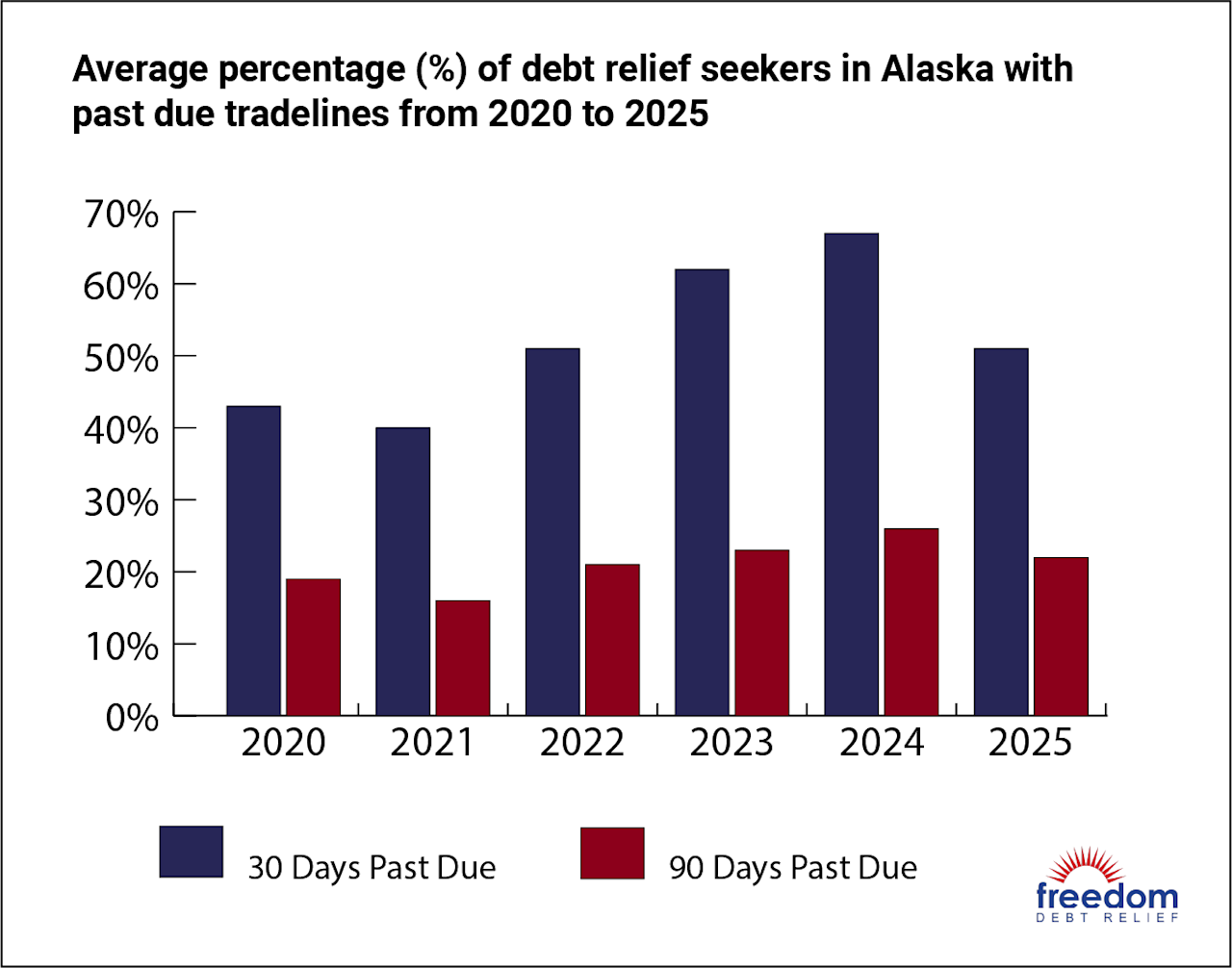

Alaska Debt Delinquencies and Collections

With Alaskan debt relief seekers facing more debt than many Americans, and facing substantial monthly expenses for things like auto loans, student loans, and mortgages, it's not surprising that some are facing collections activities.

The typical collection balance among Alaskan debt relief seekers in 2024 was $3,037, and their typical collection past-due amount was $3,008. The good news is that this is below the averages for debt relief seekers overall, whose average collection balance was $3,183, and average past-due amount was $3,061.

The average number of collection accounts for Alaska relief seekers was 1.8 in 2024, compared to 2.0 nationwide, meaning Alaskans have fewer accounts in collections than the nationwide average.

In total, 70% of Alaskans seeking debt relief reported accounts that were at least 30 days past due, while 30% had accounts that were 90 days past due. This is below the nationwide average of 80% of debt relief seekers with accounts 30 days behind, and 30% with accounts 90 days behind.

When an account becomes delinquent, this damages the account holder's credit score. It can also lead to collection activities, such as wage garnishment or lenders putting liens on property.

Lenders must go to court to pursue these remedies, though, and many prefer to avoid that, so those who are behind should be proactive in pursuing debt relief.

Alaska Statute of Limitations

When debt collectors want to collect past-due debt, they may take legal action. However, they do not have unlimited time in which those efforts are likely to succeed. There is a statute of limitations for collecting debt.

Every state sets its own statute of limitations. In Alaska, a debt collector has to sue someone within three years to collect debt owed via contract. Note that lawsuits can and do happen after the statute of limitations runs out—but at that point, debts are considered “time-barred,” and suits are generally dismissed on that basis.

There are slightly different statutes of limitations in Alaska for different situations, as the table below shows.

| Type of Debt | Statute of Limitations |

|---|---|

| Credit card debts | 3 years |

| Medical debts | 3 years |

| Auto loan debt | 4 years |

| Personal loan debt | 3 years |

| Mortgage debt | 3 years |

| Legal judgments | 10 years, and can be renewed |

Also note that if you make a payment on your debt after the statute of limitations has passed, this typically resets the clock.

What are the Alaska debt collection laws?

Alaska residents are protected by the Fair Debt Collection Practices Act and the Alaska Unfair Trade Practices and Consumer Protection Act.

According to the Alaska Department of Law, Consumer Protection Unit, debt collectors can't:

Harass or abuse you when trying to collect a debt

Make any false or misleading statements, including claiming they've taken legal action when they haven't

Call you at work if they know your employer doesn't allow it

Call you before 8 a.m. or after 9 p.m.

Call you if you tell them you have an attorney they should speak to

Tell third parties, except for your spouse or lawyer, anything about your debt, or contact third parties except to verify your information

Continue to contact you if you tell them in writing to stop

Collectors also must provide you written notification of the amount due and the creditor you owe money to within five days of contacting you, and they must include a validation notice informing you that if you don't dispute the debt in writing within 30 days, the collector will consider it valid.

Know your rights, and don’t hesitate to take action if a debt collector violates them.

Reviews and Testimonials from Alaska

Things are getting taken care of with ease.

TAMARA ROBINETTE, US

They kept me informed of every details. Changes or modifications base on every settlement.

Thach Nguyen, US

Explain every thing

Michael Stugart, US

Alaska Debt Relief

If you are among the Alaskans struggling with debt, you have options.

Debt settlement is a possible option if you can’t afford to fully repay your unsecured debts. Debt settlement means negotiating with your creditors to accept less than the full amount you owe and forgive the rest. They might do this if it’s clear that you have a financial hardship and you’re not likely to be able to fully repay the debt. Getting something is better than nothing, and it costs money to take you to court.

Debt relief programs typically take as little as 24 to 48 months, and can make repayment far simpler—you make a single, affordable monthly deposit to a dedicated account that you own and control. Once there’s enough in the account, a professional negotiator will try to work out an agreement with your creditor. If they are successful, the agreement is presented to you for approval. Once you give the green light, money from your account is used to pay your creditor. The debt settlement company’s fee is paid from the same account.

Freedom Debt Relief offers a free debt evaluation so you can find out if you’re a candidate for debt settlement.

If you can afford your debts but you need support and guidance, another option to consider is credit card counseling. Credit counseling involves working with an accredited credit counselor who sets you up on a debt management program. A DMP is a payment plan with your creditors. You pay all of what you owe, but your creditors might agree to lower your interest rate or waive fees. You make a monthly payment as part of the program, and the money is distributed to your creditors based on your payment plan. A DMP is designed to fully repay your unsecured debts in three to five years.

Is Debt Consolidation the Best Debt Solution?

Debt consolidation is one of several options for debt relief in Alaska, but it is a good option only in certain situations. Debt consolidation involves taking out a new loan to pay off existing debt. You could use a personal loan, for example.

Typically, you need a good credit score to qualify for a debt consolidation loan, and it usually only makes sense if you can consolidate your debt at a lower interest rate than you currently pay. You still pay the full amount due, but you can repay it by making one monthly payment on your consolidation loan, after you’ve used that loan to pay off your existing creditors.

If you don't qualify for a debt consolidation loan or can't afford the monthly payments, a debt management plan or debt settlement may be better options.

If you believe you could pay off your debts but need an organized plan, you could consider DIY debt relief. This usually means the debt avalanche or debt snowball. With both, you make minimum payments on all debts except one. All extra money goes to the one debt. With the snowball, you choose the smallest debt.

For the avalanche, you choose the debt with the highest interest. After you’ve paid off the debt you’re focusing on, you move on—to the next-smallest, or to the debt with second-highest interest. You then pay all extra funds to that debt, continuing this way until your debts are gone. The snowball gives you a quick win for motivation; the avalanche can save you money on interest.

You can also consider bankruptcy. Chapter 7 bankruptcy has income limits, and involves the sale of your assets to cover debts. Chapter 13, which doesn’t have the same limits, requires a three- to five-year repayment plan (which some people fail to complete).

To find out more about your options, reach out to Freedom Debt Relief today to learn how Freedom Debt Relief works and see if we can help you.

Alaskans can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

What is the statute of limitations on debt in Alaska?

For most types of debt in Alaska, the statute of limitations is three years. Lawsuits after that period can be dismissed because the debt has become time-barred. Note that if you make any payment on the debt after the three years, you might reset the clock on the statute of limitations.

What is the downside to debt relief?

Debt relief can damage your credit score. However, your credit score is often already damaged by late payments and large balances. Debt relief allows you to get a fresh start by making it easier to repay what you owe and rebuild your credit.

What should I say to settle a debt?

If you are negotiating with creditors to try to settle a debt, explain that you are experiencing financial hardship and can't pay. Be prepared to offer a lump sum if you want to settle for less than you owe. You can also work with a professional debt settlement company like Freedom Debt Relief, which negotiates with creditors on your behalf.

End Your Debt

Find out how our program could help.

- One low monthly program deposit

- Settlements for less than owed

- Debt could be resolved in 24-48 months