Texas Debt Relief By the Numbers: 5-Year Debt Trends

Hundreds of thousands of Texans struggle with debt every year. It's important to know there is help available for this heavy burden.

Credit problems are a national issue, and it's clear they've taken an especially heavy toll in Texas. According to FICO, the average credit score in Texas is 695, which is well below the national average of 715. According to the Federal Reserve Bank of New York, the percentage of credit balances with payments 90 or more days late is much higher in Texas than in the country as a whole.

Some other signs of trouble: TransUnion says that the average credit card balances in Texas are well above the national average. A higher proportion of Texans are behind on payments for their auto and personal loans, as well as for their credit cards and mortgages. With an average income that's significantly below the U.S. average (according to the Bureau of Labor and Statistics), a lot of households in Texas are having a tough time making ends meet.

The cost of debt only makes it harder. If you need a way out, there is hope. It starts by getting to know your rights as a borrower and what kinds of debt relief help are available.

Texans can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

5-Year Debt Trends in Texas

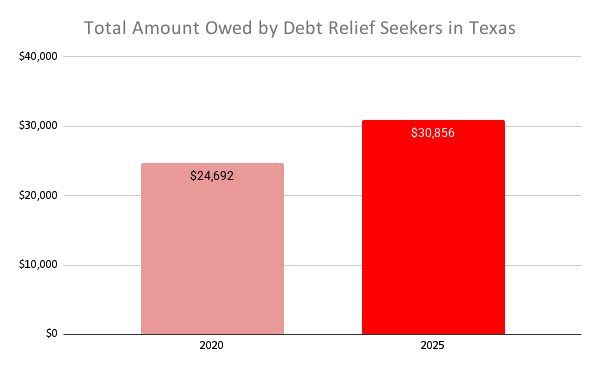

If it feels like debt problems have been getting worse in recent years, you're not imagining things. Freedom Debt Relief has statistics on the financial status of people who've inquired about debt relief. For those in the Lone Star State, the average amount of reported debt is up by 25% over the past five years.

Here are some other stats that tell the story of the problems debt relief seekers in Texas are facing:

At $30,856, the average amount of debt is more than $4,000 above the average owed by debt relief seekers nationwide.

Since 2020, the total monthly minimum payment on debt has risen by 14.4%.

At $1,922, that monthly minimum is $123 more than the average for debt relief seekers nationwide.

The 46.9% average debt-to-income (DTI) ratio in Texas is higher than the overall average of 42.3%.

People's debt problems seem to peak in the middle-age years. Between 36 and 50, both the average dollar value of debt and average DTI ratio peak.

Even some people with high incomes get in over their heads. Among debt relief seekers in Texas with salaries over $200,000, the average DTI ratio is 75.5%. That means three-quarters of their income goes towards debt payments.

Maxing out your credit cards is a clear sign of trouble. People with poor credit scores (below 580) were using 93% of their credit limits, as opposed to just 8.4% for people with excellent credit (800 or better).

The nature of your credit problems isn't just a matter of stats like these. It also depends on the type of debt you have.

Texas credit card debt

Nearly two-thirds of consumers in Texas who've inquired about debt relief have credit card debt. Those that do owe an average of $15,541 on their cards. This is actually about $700 less than the average for debt relief seekers nationwide. The average number of credit card accounts in Texas is 7.3, just a bit below the average of 7.4 accounts nationally.

The $471 in monthly minimum credit card payments that Texans face is also a little below the average. But Texans also earn less than debt relief seekers nationwide. So those minimum payments represent a greater burden.

For the third straight year, the average amount of credit card debt has risen for debt relief seekers in Texas. The average overdue balance has also increased for three years in a row. At $5,607, this represents more than a third of the overall credit card balance owed.

Credit card debt often represents a particular pain point for two reasons:

Credit card interest rates are generally much higher than for other conventional forms of consumer debt. This makes it an especially expensive type of debt to carry.

Monthly minimum payments on credit card debt are deceptively low. Far from being helpful, those low payments can drag your debt out for a longer time. As a result, you pay more interest. It also makes it easy for you to grow your debt over time instead of paying it down.

These are reasons why seeking credit card debt relief is usually a priority. Fortunately, since credit card debt is unsecured, there are more debt relief options than for secured debt.

Texas auto loan debt

Texans put a lot of money into their vehicles, and this is reflected by the amount of auto loan debt they have.

Debt relief seekers in Texas with auto loans owe an average of $32,113 on those loans, which is more than $5,000 above the average for debt relief seekers nationwide. The average monthly payment on these loans is $870—significantly more than the typical American pays. These figures are usually spread across more than one loan, with the Texas average 1.5 active auto loans.

Most auto loans have fixed monthly payments. which makes them easier to budget for. However, since these loans are generally secured by the vehicle they were used to purchase, this can be a high-stakes form of debt. You can't typically negotiate to settle secured debt for less than the full amount you owe. If you fail to make your payments, your vehicle could be repossessed.

Texas mortgage debt

Mortgages account for most of the household debt in the U.S., and Texas is no different. Debt relief seekers in the state with mortgages have an average balance of $224,071, far more than for any other type of debt.

That $224,071 mortgage balance figure is lower than the balance owed by debt relief seekers nationwide. However, property values in Texas are typically lower than in the nation as a whole. A lower mortgage balance doesn't necessarily translate into more equity in the home.

The average monthly payment on these mortgage balances is $2,046. This is far more than the payments on any other type of debt. That’s why mortgage payments tend to dominate household budgets. And mortgages are a priority because they're secured by the property. This makes them tough to negotiate settlements on, and nonpayment could mean losing your home.

Texas installment loan debt

Another common form of installment debt is personal loans. Personal loans are generally a cheaper option than credit card debt, though this can vary greatly based on your credit qualifications.

Debt relief seekers in Texas with installment loans owe an average of $13,556. Payments on these loans eat up an average of $534 of their monthly budgets. Those average balance and payment figures are both higher than the averages for debt relief seekers nationwide.

Most personal loans are unsecured. This could give you some flexibility if you need debt relief. When there's no collateral on a loan, it's easier to renegotiate loan terms, including a possible settlement for less than the full amount you owe.

Texas student loan debt

Student loans have become an urgent problem over the past year or so.

Many borrowers may almost have forgotten about student loans when payments were suspended during the pandemic. However, delinquency rates on these loans have jumped since payments resumed. A FICO report found that one in seven members of Gen Z—the age group most likely to have student loans—suffered a credit score loss of 50 points or more over the past year.

Debt relief seekers in Texas with student loans had average balances of $46,532. The average monthly payments on these loans averaged $287.

The problem with student loans is that the amount owed can't be negotiated. However, federal student loans do have programs to help people who are having trouble paying. You could apply for an income-driven repayment program. You may even have a portion of your loan forgiven if you meet certain criteria based on occupation or ability to pay.

Texas Debt Delinquencies and Collections

Though Texans have more of some types of debt than others, the overall debt burden has been getting heavier. So how well are they keeping up with that burden?

Based on the stats on people looking for debt relief help, some are really having a hard time. One way to tell is by looking at overdue payments and accounts that have been referred for collection.

People seeking credit card debt relief have average overdue balances of $5,607. That figure is up by 19.4% over the past five years, including a 10% jump since just last year.

When a creditor gives up on trying to collect a debt, they often refer the debt to a collection agency. When an account is referred for collection, it's noted on your credit report. This could be a red flag for potential lenders and may hurt your credit score.

In Texas, it’s fairly common for debt relief seekers to have accounts referred for collection:

22.2% had at least one account referred for collection, which is much higher than the 13.1% nationally.

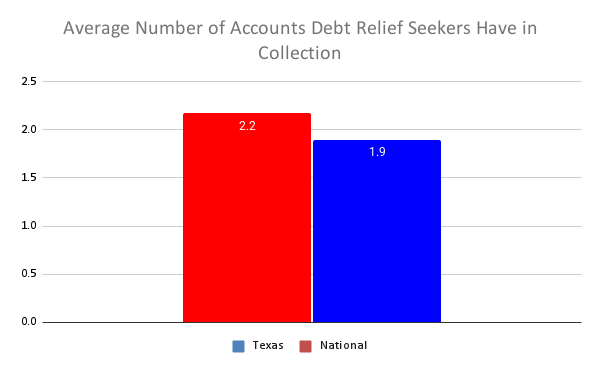

Those with accounts in collection had an average of 2.2 such accounts, which is more than the 1.9 average for debt relief seekers nationwide.

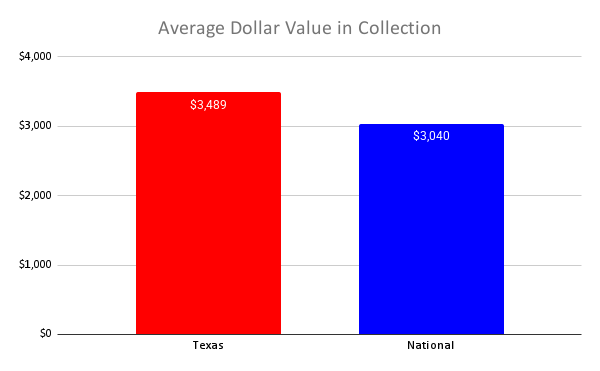

The average dollar amount in collection for Texas was $3,489, worse than the average of $3,040 for debt relief seekers nationwide.

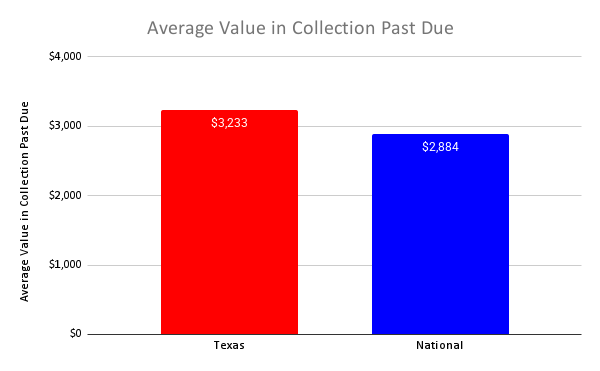

Over 90% of the amount in collections have payments past due.

These charts summarize how bad this problem is:

If you have accounts in collection, it's probably a good time for you to consider debt relief options. If you haven't got to that point but are starting to fall behind on your payments, you might want to consider those options before things get any worse.

Texas Statute of Limitations

When considering your options for handling debt, it helps to learn about Texas debt laws. Debt collection is subject to a statute of limitations. This is a time limit on how long a debt collector has to bring a lawsuit to collect a debt.

There’s no federal statute of limitations on debt collection. Instead, this time limit varies from state to state. The statute of limitations for debt in Texas is four years. This means a creditor has four years from a debt becoming overdue to file a lawsuit to collect it.

After the statute of limitations expires, the debt collector may still try to collect. Nonpayment of the debt may still appear on your credit record. However, you’d no longer be under threat of a lawsuit that could force you to pay the debt.

In Texas you get special protections that not all states have. Unlike in some other states, making a partial payment or verbally acknowledging the debt can’t restart the statute of limitations. Also, in other states, if a creditor sues you after the statute of limitations has run out, they still have a chance at winning a judgment against you. In Texas, a creditor has to notify you in writing if they are taking action after the statute of limitations has expired. You should still answer debt collectors and show up in court if they sue. But for old debts, the law is on your side in Texas.

Seek legal advice about how the statute of limitations applies to your situation before you assume protection under it.

What are the Texas state laws regarding debt collection practices and consumer rights?

The Texas Debt Collection Act protects residents from abusive and fraudulent debt collection practices. Under the Act, debt collectors cannot:

Threaten you with violence or other criminal acts

Use profane or obscene language

Falsely accuse you of fraud or other crimes

Threaten to repossess or seize your property without a court order

Harass you with anonymous phone calls or excessive calls

Call you collect without disclosing their real name before you accept the charges

Use a false name or identification

Misrepresent the amount of the debt or its judicial status

Send falsified documents to create the impression that they come from a court or other official agency

Fail to disclose who holds the debt

Misrepresent their services

Use false representation to gain access to your information

Try to collect more than the amount agreed upon

If a debt collector violates your rights, you can report them to the Texas attorney general's office. Violations can trigger criminal and/or civil penalties.

Reviews and Testimonials from Texas

Freedom Debt Relief has taken my credit card debt and is negotiating with the the companies. On a fixed income FDR has relieved a great deal of stress from my life, They are very easy to work with.

Cynthia White, US

Very helpful a friendly.

Norm Appleton, US

I have never spoken to anyone at freedom debt relief that is not friendly, courteous, and most helpful. They always answer any questions I have And are very knowledgeable about the process. I have felt so comfortable going through this process And would recommend freedom to anybody who is considering a debt relief program.

Marcia Sands, US

Texas Debt Relief

If you’re in Texas and you can’t afford to fully repay your debts, you could certainly negotiate with your creditors yourself. There’s no reason you couldn’t call them up, explain your hardship, and make an offer. Creditors often play hardball, though, and some people feel stressed by the process. You also have the option to let a professional debt settlement company like Freedom Debt Relief negotiate on your behalf. It’s possible to get significant debt reduction through settlement.

As you consider your debt relief options, make sure you learn about Texas financial hardship programs offering financial assistance and advice. Here are some examples:

Healthcare expenses are often a cause of debt. You can find out about federal Medicare and Medicaid programs to help with these expenses through the Centers for Medicare & Medicaid Services.

The Texas Department of Health and Human Services offers information on a variety of state relief programs. These services include help with healthcare insurance, food benefits and emergency payments for essential needs.

The state government provides financial hardship assistance for renters and homeowners.

The U.S. Department of Justice has a search tool that can help you find approved credit counselors in Texas.

The Texas Legal Services Center offers free assistance to low-income Texans. This legal assistance can help you access healthcare, housing and government benefits.

What are the different types of debt relief programs available for Texas residents?

Texas residents’ options for debt relief include:

Debt settlement

Credit card hardship programs

Debt management plans (DMPs)

Debt consolidation

Bankruptcy (Chapter 7 or Chapter 13)

There are no state-sponsored programs for debt relief in Texas. If you get phone calls, emails, or letters from companies that claim to be able to help you walk away from debt, use caution. Those could be signs of a scam.

If you need to talk to someone about your debt, the Texas Office of Consumer Credit Commissioner (OCCC) encourages you to reach out to a credit counseling agency. You can find links on the OCCC website. A credit counselor can look at your income, expenses, and debt to determine whether you’re a candidate for a debt management plan. The OCCC regulates credit counselors in the state to make sure Texas residents are protected from unfair or unethical practices.

You can also get a free debt evaluation from a debt expert at Freedom Debt Relief. Click “See if you qualify” above.

Is Debt Consolidation the Best Debt Solution?

If you feel you could pay your debts if the payment terms were a little easier, debt consolidation might be a good choice.

With debt consolidation, you borrow money to pay off some or all of your other debts. The point isn’t just to move debt from one creditor to another. In the process, you should accomplish one or more of the following:

Simplify your monthly payments by merging multiple payments into one

Lower the interest rate on your debt to reduce your borrowing costs

Reduce monthly payments by stretching repayment over a longer time, though this may raise your long-term interest costs.

This approach makes the most sense if your credit is still in pretty good shape. It allows you to avoid the kind of hit to your credit that bankruptcy or debt settlement might deliver. Better credit also makes it more likely that you can qualify for a debt consolidation loan.

With an average credit score that's well below the national average, some Texans may have a harder time qualifying for a cost-effective new loan.

If your debts are too big to afford under any circumstances, debt consolidation might not be as strong a solution as debt settlement. This is especially true if you have a lot of unsecured debt, like credit card debt.

What are the pros and cons of debt settlement versus debt consolidation in Texas?

Debt settlement could help Texas residents pay off debts for less than what's owed. Debt settlement is for someone with financial hardship. A settlement may be a good choice if you:

Mostly owe debts that don't have to be paid back, like credit cards or medical bills.

You're late on payments, or you might be late.

You want cheaper monthly payment than what you have now.

You want to pay off your debt faster than you can.

Debt consolidation is combining multiple debts into one, usually through a loan. For example, you might use a home equity loan to pay off credit cards and other debts. Debt consolidation lets you replace multiple payments with just one.

Consolidation could be a better fit if you can afford to make your monthly debt payments, but want to simplify them. Unlike debt settlement, consolidation won't reduce the total amount you owe.

Texans can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

Can Texas debt relief programs help with medical debt or student loans?

Texas debt relief programs could help with medical debt or student loans if you qualify for debt relief.

A debt relief company might be able to help you:

Create a monthly budget that allows you to manage medical bills and/or student loan payments

Negotiate a settlement of medical debts or private student loans that are in default

Find a consolidation loan for your medical bills

Help you weigh your consolidation or refinance options for student loans

Compare the range of services different companies offer to find one that helps with medical and education debt. You can also explore other options for help, outside of debt relief companies.

Texas charity care programs, for example, help with medical bills for people in financial need. Government-sponsored loan repayment programs offered in the state could help reduce the cost of student loans for borrowers who work in certain career paths.

How to qualify for government-assisted debt relief programs in Texas

The only government debt relief program available in Texas is bankruptcy. Chapter 7 bankruptcy eliminates eligible debts. Chapter 13 lets you repay them over three or five years.

Chapter 7 eligibility is based on your income, compared to the median income in your state, by household size. If your income is below the threshold, you qualify.

Here are the median incomes for Texas by household size, as of June 2025:

Family of 1: $63,448

Family of 2: $83,037

Family of 3: $95,391

Family of 4: $110,719

*Add $11,100 for each additional person above four.

In a Chapter 7 bankruptcy, you might have to give up some of the things that you own and turn them over to the court. Those assets are sold, and the money is used to pay your creditors.

Everyone who files bankruptcy gets to keep something. Texas is unique because it’s the only state where you get to keep the entire value of your home.

How does filing for Chapter 7 bankruptcy in Texas impact your credit score and future borrowing?

Chapter 7 bankruptcy causes severe credit score damage. The higher your score is before you file for bankruptcy in Texas, the steeper the drop is likely to be. You may not notice as much of a dip if your score is already low when you file.

A Chapter 7 bankruptcy remains on your credit report for 10 years. Over time, the credit score impact begins to fade.

You might start getting offers for credit immediately after your bankruptcy is complete. That’s because creditors know you can’t file for bankruptcy again for a number of years. Expect these offers to be very expensive.

Try these tips to start rebuilding your credit standing:

Apply for a small credit-builder loan

Pay bills on time or early each month

Apply for a secured credit card with a cash deposit and avoid carrying a balance

List of accredited non-profit credit counseling agencies in Texas

A nonprofit credit counseling agency could help you understand your debt situation and explore a debt management plan. Here are some of the options you may consider if you need an accredited, nonprofit credit counselor in Texas.

Money Management International (MMI): MMI can offer guidance on debt resolution and debt management plans.

American Consumer Credit Counseling (ACCC): American Consumer Credit Counseling's team of experts can provide help with debt management plans.

Navicore Solutions: Navicore offers help with debt management plans.

Accredited credit counseling agencies also offer the course that’s required of anyone filing for bankruptcy protection.

Other notable nonprofit accredited credit counselors that operate in Texas include 1$ Wiser Consumer Education, Debt Education and Certification Foundation, and GreenPath Financial Wellness.

Nonprofit credit counseling agencies typically don’t offer other debt solutions besides a debt management plan. If you want to weigh all of your options, it’s a good idea to talk to a bankruptcy attorney and a debt settlement expert as well.

Compare the best debt relief companies operating in Texas

The Association for Consumer Debt Relief offers a list of accredited debt relief companies. This could be a good starting point for finding those that operate in Texas.

The best Texas debt relief companies offer actionable solutions and charge reasonable fees. Some of the best debt relief companies include:

Freedom Debt Relief: The nation’s leading debt settlement company also has a network of partners who can provide help with debt consolidation loans.

Other top debt relief providers include:

National Debt Relief

Pacific Debt Relief

Accredited Debt Relief

All four debt settlement companies have excellent ratings on TrustPilot and an A+ rating with the Better Business Bureau (BBB).

What are the common signs of a debt relief scam in Texas and how to report it?

Texas debt relief scams can cost residents money, but there are two simple ways to identify them:

Help comes to you. A debt relief company that offers to help you even though you haven't reached out to them could be a scam. Watch out for unsolicited phone calls, emails, letters, or texts.

Demands for payment upfront. No reputable debt relief company asks for payment upfront. If a company requires you to pay before they'll help, or they ask for payment through unusual methods, like Cash App or Venmo, you may want to look elsewhere for debt relief.

If you think you've been targeted by a debt relief scammer, report them to the Texas attorney general's office. You can also file a complaint with the Consumer Financial Protection Bureau (CFPB) and submit a report to the Federal Trade Commission (FTC).

What are the average fees or costs associated with debt management plans in Texas?

Texas debt management plans may come with a one-time setup fee and monthly fees. The average fee can vary by company and by the number of accounts you enroll in the plan.

State law limits how much debt management companies can charge, so fees aren't unlimited.

Here are the statutory limits on debt management plan fees as of June 2025:

Debt management setup fee: $136

Debt management monthly service fee: Lesser of $14 per account or $68

Counseling or education if no debt management service is provided: $136

Fee for dishonored payment: $30

Debt settlement fees are also subject to caps under Texas law. The maximum setup fee allowed is $544, while monthly service fees are limited to the lesser of $14 per account or $68.

If you're considering a debt management plan in Texas, review the fees before you enroll. Ask for an explanation of any fees that you don't understand.

End Your Debt

Find out how our program could help.

- One low monthly program deposit

- Settlements for less than owed

- Debt could be resolved in 24-48 months