Arizona Debt Relief By the Numbers: 5-Year Debt Trends

If you're an Arizona resident who finds it difficult to keep up with expenses, you're not alone. In a challenging economy, people in Arizona have it just a little tougher than most.

At $65,740, the average income in the state is a couple thousand dollars below the national average. The average FICO Score for consumers in Arizona is 712, very near the national average of 715.

Not surprisingly then, people in Arizona carry a heavier debt burden than Americans overall. Unfortunately, many people in the state seem to be losing the battle against debt. The average credit card balance in Arizona is higher than the national average. Late payment rates on auto loans and credit cards are worse than the national averages.

If these struggles sound familiar, know that there's help available. Tens of thousands of people in Arizona seek debt relief every year. Getting to know your options is the first step toward finding the right solution.

Arizonans can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

5-Year Debt Trends in Arizona

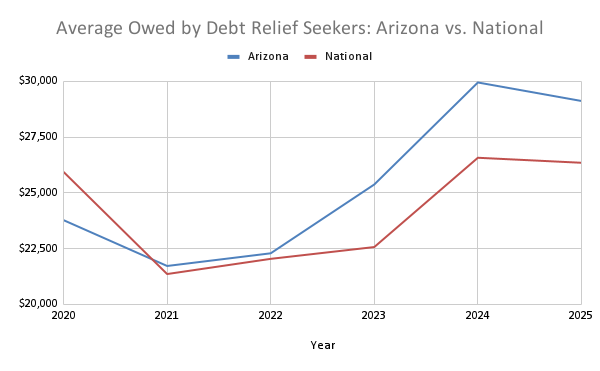

How did the debt situation in Arizona get to be so difficult? A look at the growth in the amount owed by people seeking debt relief in Arizona helps tell the story:

Not only has the average amount owed risen sharply since 2020, but in that time Arizona debt seekers have gone from owing less than the national average to owing more.

Here are some other key stats on the burdens faced by people seeking debt relief in Arizona:

Since 2020, the average monthly minimum debt payment has jumped by 27%.

At 46.5%, the average debt-to-income (DTI) ratio is well above the national average of 42.3%.

Since 2020, the average balance owed has grown in every category of debt: credit cards, personal loans, auto loans, mortgages, and student loans.

Debt burdens generally get worse with age, with DTI ratios rising steadily and peaking at 49.6% for people aged 51 to 65 before falling off somewhat once people reach retirement age.

Earning a high income doesn't necessarily protect you from debt problems. Among people seeking debt relief help, people with incomes above $200,000 had the highest DTI ratio at 72.2%. That means nearly three-quarters of their income is going to monthly debt payments.

Maxing out credit lines is a clear sign of credit problems. People with credit scores below 580 were using 93.8% of their available credit, compared with just 9.1% for people with exceptional credit (scores of 800 or better).

Of course, not all debt is the same. For a deeper dive into debt trends in Arizona, it helps to look at the categories of debt individually.

Arizona credit card debt

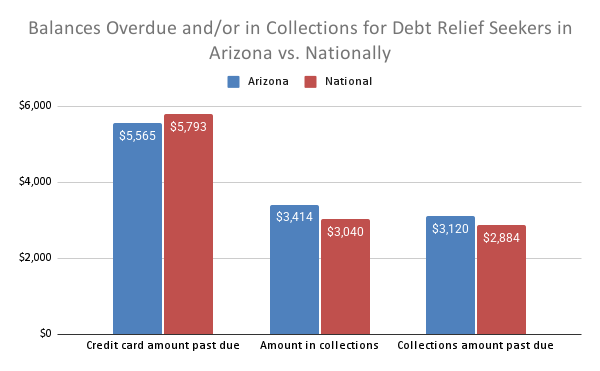

Debt relief seekers in Arizona owe an average of $15,013 in credit card debt. Over a third of that, $5,565, is past due.

Those figures are actually a little below the averages of $16,244 and $5,793 nationally. Also, debt relief seekers in Arizona have slightly fewer credit card accounts than the national average, with 6.8 accounts, compared to 7.4 nationally. Along with this, the average monthly payment of $454 is below the national figure of $489.

Still, even with slightly smaller balances, credit card debt can be especially troublesome, because credit cards typically carry a much higher interest rate than most forms of debt. The average interest rate for credit cards is 22.83%, and this often exceeds 30% for people with lower credit scores.

Also, credit cards typically have fairly low monthly minimum payments. That sounds user-friendly, but those low payments stretch your debt out over a longer time so you pay more in interest. They also make it easy for your balance to grow steadily over time.

One positive about credit card debt is that it's usually unsecured debt. That makes credit card debt relief programs a possible solution for people who can't keep up with their payments.

Arizona auto loan debt

Auto loans are a heavier burden for debt relief seekers in Arizona than they are nationally. The average auto loan balance is $28,323 in Arizona, more than the national average of $26,997. The average monthly auto loan payment of $750 is just $1 above the national average. However, since the average income in Arizona is lower than the national average, it represents a heavier burden.

Unlike credit card debt, auto loans typically have fixed monthly payments. That makes them easier to plan for. On the negative side, auto loans are secured debt—if you don't make your payments, you could lose your car.

Secured debt like an auto loan isn't as good a candidate for debt relief as credit card debt.

Arizona mortgage debt

Mortgages represent the largest type of household debt in the United States. Among debt relief seekers in Arizona, the average mortgage balance is $283,120. This is well above the national average of $239,406.

As a result, debt relief seekers pay more toward their mortgages every month. The average payment in Arizona is $2,007, compared with $1,989 nationally. These higher mortgage costs in Arizona are no surprise, as the median home price in the state is considerably higher than the national average.

Mortgage debt is secured debt. That generally makes it the most important type of debt people have, especially if the mortgage is for a primary residence.

Arizona installment loan debt

Installment loans, such as personal loans, are loans with regular monthly payments. Installment debt can be secured or unsecured, though most installment debt is unsecured.

Debt relief seekers in Arizona owe an average of $14,030 in installment debt. This is higher than the national average of $12,632. As a result, they also have higher monthly payments on this kind of debt—$504, compared to $485.

Average interest rates on personal loans are generally about half of those on credit cards. However, this can vary widely, depending on your credit score and other factors. As long as your installment debt is unsecured, it can be a good candidate for debt settlement.

Arizona student loan debt

Student loan payments were suspended during the pandemic. Delinquency rates on student loans soared in 2025 after payments were resumed.

Borrowers seeking debt relief in Arizona owe an average of $45,683 in student loans. Their average monthly payment on these loans is $287. Fortunately, both those figures are well below the national averages.

Student loan debt is not subject to negotiation, so it's not a great candidate for debt relief. On the plus side, student loans generally have relatively low interest rates. Also, if your loan is federally sponsored, you can apply for an income-driven repayment plan to make your payments more affordable.

Arizona Debt Delinquencies and Collections

Just how serious are debt problems in Arizona? Those with accounts in collections had an average of 2 such accounts, compared to 1.9 accounts nationally, but 18.6% of debt relief seekers in the state had at least one account in collections, compared with 13.1% nationally.

The most common type of debt cited by Arizonans seeking debt help is credit card debt—67.8% said they had this type of debt.

The following is a snapshot of how the balances in collection and past-due in Arizona compare to those nationally:

While debt relief seekers in Arizona have a little less money in credit card balances that are past due, they owe more money that has been referred to a collection agency, and have higher balances in past-due collection accounts.

When an account gets referred to a collections agency, it has become a bigger problem. Most likely, the overdue payments plus having the account referred to collections have done significant damage to someone’s credit score. The collections agency may be persistently contacting the borrower.

If you feel you’re approaching this kind of problem, it's vital to know your rights and your debt relief options.

Arizona Statute of Limitations

The statute of limitations (the time limit within which a creditor can sue you) in Arizona varies according to the type of debt:

Medical debt: 6 years

Credit card debt: 6 years

Debt agreed to by contract: 6 years

Auto loan debt if the vehicle has been repossessed: 4 years

State tax debt: 10 years

The statute of limitations is not the only law protecting borrowers from debt collectors in Arizona.

What are the Arizona debt collection laws?

Arizona residents are protected by provisions of the federal Fair Debt Collection Practices Act (FDCPA), as well as some state rules.

The FDCPA requires that debt collectors send a written validation notice within five days of making contact. This notice must state the amount owed, name of the creditor, and information on how to dispute the debt. The FDCPA also limits when they can call and what they can say. The FDCPA allows you to stop debt collectors from contacting you, but doesn’t prevent them from suing you.

Debt collection laws specific to Arizona include limits on wage garnishment, protection of certain assets, and maximum interest rates on medical debt.

What are the latest changes to Arizona debt relief laws as of 2025?

The most recent significant change in Arizona debt relief laws was the passage of Proposition 209 in 2022. Also known as the Predatory Debt Collection Act, it changed laws regarding the value of property exempt from bankruptcy judgments. It also reduced the portion of wages that creditors can garnish.

Under this law, the value of a personal residence that’s exempt from a bankruptcy judgment increased from $250,000 to $400,000. It raised the exempt value of household furnishings and appliances from $6,000 to $15,000. The exempt amount of equity a debtor owns in a motor vehicle was raised from $6,000 to $15,000, or to $25,000 if the debtor has a physical disability.

Also under Proposition 209, the percentage of disposable income that can be garnished dropped from 25% to 10%. Garnishment is when a creditor takes a portion of your pay before you get the money.

Reviews and Testimonials from Arizona

Pep talks & timely explanations to questions.

Dayna Edwards, US

The whole process has been amazing, since the beginning tailored to me and my current situation, and consistently fighting for me and getting me the bet settlements, I wouldn't have been able to get out of debt so quickly without FDR. It's had an incredible impact in my life and I an forever grateful!

Reidry Zerpa, US

Freedom debt relief is a caring team of people helping to resolve your debit relief. I thanked them so much for helping me thank you freedom debt relief, and please keep up the good work because there’s so many people out there that need help that don’t know where to start like I was thank you

Carlotta Lawrence, US

Arizona Debt Relief

There are a variety of services in Arizona for people experiencing financial problems. These include financial aid, legal assistance, and debt relief.

What are the main types of debt relief options available in Arizona?

The Arizona Department of Economic Security (DES) offers emergency financial assistance for needy families, including help with food, housing, child care, and utility payments. The DES also offers some legal services which may help you deal with legal issues resulting from debt. You might also qualify for basic legal aid from AZLawHelp.org for issues like eviction.

Emergency financial assistance may help you pay your bills, but it doesn't directly help with debt. For that, consider other debt relief options, including debt management plans, debt settlement, and bankruptcy.

If you’re considering a debt management plan, you can use the U.S. Department of Justice search tool to find approved credit counseling agencies near you. For debt settlement, check with the Association for Consumer Debt Relief. For bankruptcy, search online for a bankruptcy attorney who’s licensed to practice in your area.

Best debt settlement companies in Arizona as of October 2025

And if you're considering debt settlement, here are a few specific things to look for in a debt relief professional:

Experience negotiating debt settlements in Arizona. Debt laws vary from state to state. Familiarity with them could impact negotiation.

Professional accreditations. Look for certification from the Association for Consumer Debt Relief and the International Association of Professional Debt Arbitrators.

An extensive track record of success. Look at the length of time they've done business, the number of people they've helped, and the results they've gotten.

Positive customer ratings on Google, Trustpilot, and Best Company.

No upfront debt settlement costs. A debt settlement professional can’t charge you fees for settling debts until after they negotiate an agreement and at least one payment toward it has been made.

Debt relief is available for even large amounts of debt. Is it the right solution for you? It may be well worth finding out.

Is Debt Consolidation the Best Debt Solution?

Another approach to consider is debt consolidation.

What are the requirements for debt consolidation in Arizona?

Debt consolidation means using a new loan to pay off multiple debts. The key requirement for debt consolidation in Arizona is qualifying for new credit.

Debt consolidation can accomplish a variety of goals. Ideally, it lowers the interest rate on your debt. Debt consolidation also simplifies your debt payments, because you trade multiple monthly payments for just one.

High-interest debt like credit card debt is a great candidate for debt consolidation. Personal loans, home equity loans, and balance transfer credit cards are all possible sources of lower-cost credit for debt consolidation.

Qualifying for new credit depends on key factors like your income, your expenses, and how much other debt you have. It also helps to have above-average credit. In 2025, the average credit score in Arizona is 712. You can get a new debt consolidation loan with below-average credit, though you have lower chances of getting a better interest rate.

What's the difference between debt consolidation and debt settlement in Arizona?

Debt consolidation is different from debt settlement. With debt settlement, you ask your creditors to accept less than the full amount you owe and forgive the rest. A key difference is that debt consolidation doesn’t reduce the total amount you owe. However, it may decrease the cost of your payments if you can pay off old debt at a lower interest rate.

Debt consolidation could have a mild negative impact on your credit report, because you’re opening a new credit account. But making your new loan payments on time could have a positive effect.

Besides debt consolidation and debt settlement, other possible solutions include:

Payment organization systems, such as the avalanche method, in which you put any extra money toward paying off your highest-interest debt first. This reduces your total interest payments.

Credit card hardship programs. Credit card companies don't often publicize these, but some offer them under special circumstances.

Debt management plans (DMPs) offered through nonprofit credit counselors

Debt consolidation if you qualify for less-expensive credit to pay off high-interest debt

Debt settlement from private debt relief companies

Bankruptcy (Chapter 7 or Chapter 13)

These are all different paths to the same goal: finding a secure financial future.

Arizonans can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

How does Chapter 7 bankruptcy work in Arizona?

Chapter 7 bankruptcy involves giving up some of the things you own to pay off debt. To qualify, you must have a relatively low income. The income limit is based on the median income in the state. In 2025, the Chapter 7 income limit for a single-person household in Arizona was $70,919. This limit is adjusted for the size of your household.

Chapter 7 bankruptcy in Arizona can be resolved in a matter of months. You’re allowed to keep certain things, such as necessary household goods, clothing, and possibly your car and your home.

The court sells what you’re not allowed to keep, and a bankruptcy judge decides how to split the money among your creditors. Any remaining eligible debt is erased. Note: there are some debts you can't get rid of through bankruptcy. A bankruptcy attorney can give you full information. You can also get free information from the U.S. Bankruptcy Court for the District of Arizona. They offer videos, a telephone hotline, and in-person consultations with volunteer attorneys.

Are there non-profit credit counseling services in Arizona?

Yes. The U.S. Department of Justice offers a list of nonprofit credit counselors in Arizona, and there are many. Some of the credit counselors on the DOJ list are outside Arizona, but all are approved to provide services to Arizona residents. Services may be provided in person, online, or by telephone.

A credit counselor may suggest a debt management plan (DMP). With a DMP, you send a single payment every month to the counseling agency. The credit counselor then makes sure the money is distributed to your creditors. There’s typically a modest monthly fee for the DMP.

A DMP doesn’t reduce what you owe. However, the credit counselor may get some creditors to agree to lower your interest rate and possibly waive some fees.

Even if a credit counselor is a nonprofit and on an approved list, you should still check their qualification and background to make sure they're right for your needs.Are there non–profit credit counseling services in Arizona.

How does a debt management plan affect credit score in Arizona?

Enrolling in a debt management plan (DMP) in Arizona shouldn’t directly affect your credit standing. However, some of the steps you take as part of a DMP may impact your credit score.

Expect short-term negative credit impact, for instance, if your DMP requires you to close your credit card accounts while they have balances. Reducing your available credit can immediately raise your credit utilization ratio. Also, closing older credit accounts may reduce the age of your credit.

On the other hand, guidance from a credit counselor could help you manage your finances, keep up with your payments, and build a positive payment history. Payment history is the biggest factor in calculating credit scores. And as part of negotiated payments within a DMP, some creditors may agree to update your payment status to “current” from “past due.”

In short, the positive impacts of a DMP can outlast negative ones. The key is to complete the plan, and avoid new debt.

What are the pros and cons of filing Chapter 13 bankruptcy in Arizona?

Chapter 13 bankruptcy requires you to agree to a payment plan over a three- to five year- period. Here are some of the pros and cons of Chapter 13 bankruptcy in Arizona:

| Pros | Cons |

|---|---|

| Can keep assets | Five-year repayment period, or three if your income qualifies |

| Stops collections. Could help you save a home that’s in foreclosure | Requires that you pay all of your disposable income into the plan. The court tells you how much to pay after accounting for your essential expenses. The payment could be unaffordable. |

| Remaining debt may be discharged (forgiven) after completion of the payment plan | You must have a steady income to be eligible. |

| Creditors can’t opt out. | Will remain on your credit report for seven years from when you file. |

End Your Debt

Find out how our program could help.

- One low monthly program deposit

- Settlements for less than owed

- Debt could be resolved in 24-48 months