You Built an Emergency Fund During Lockdown. Time to Spend It?

UpdatedFeb 15, 2026

- Nearly half of Americans were able to save money during COVID lockdown.

- If you saved but have higher-interest debt, pay it down.

- You can also add to your retirement savings.

Table of Contents

- Americans are saving more during the pandemic

- Who has built up savings during the pandemic?

- When to use your emergency fund

- Can your emergency fund be too big?

- Steps to help manage your money better

- If you want to keep managing your savings, forbearance could help

- When you’re unsure of which financial step to take

We all know the importance of an emergency fund. It shelters you from going into further debt and is a quick way access cash flow for an unexpected expense. But as the recession and pandemic continue to impact the economy, Americans are rethinking how to use their emergency funds and when they might start to spend them.

Even if you’re still stockpiling cash any way you can, you might be wondering if it’s time to start spending this savings during a very tough financial time. Let’s take a look at some ideas on when to it might be best to use your emergency fund as well as creative ways to manage your cash flow during these unprecedented times.

Americans are saving more during the pandemic

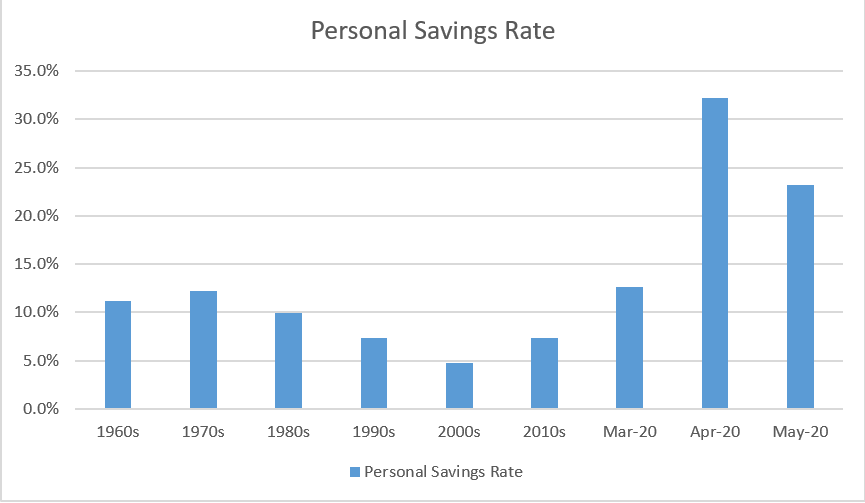

The U.S. Bureau of Economic Analysis revealed that Americans have increased their personal savings rate month-over-month since March.

Source: U.S. Bureau of Economic Analysis

A personal savings rate is a percentage of disposable income that people save. Many are saving more because of pay cuts and the simple fact that there are fewer opportunities to spend – many retailers are still closed. Another reason people are saving more is because they’re uncertain of what will happen next. During the Great Recession, for example, many households decided to build precautionary savings to protect their cash flow against job loss. With more savings in place, some households reduced outstanding debt balances.

Who has built up savings during the pandemic?

Nearly half of American workers who are now on unemployment are actually making more than they did with their current jobs which means they are able to save more easily. Despite employment status, Millennials and the Silent Generation have saved more than any other generation. Nearly one-fifth of Millennials and 16% of the Silent Generation actually increased their savings. Not surprisingly, those with higher incomes were able to save more, too. Those who earn $80,000 per year or more were able to save the most.

Although saving is important for everyone, it may be most important to people living paycheck-to-paycheck. Working Americans who are employed in industries like live entertainment, food services, or hospitality could benefit from a bigger savings cushion, if they can afford to build one. Leisure and hospitality workers saw the biggest dip in employment levels with nearly 500,000 lost jobs between February and June this year. The current unemployment rate is hovering around 11% . Some workers are using their unemployment checks and extra stimulus money from the CARES Act to build up their savings.

When to use your emergency fund

There are a few scenarios when you could tap into your emergency fund, for example, when you experience job loss, a reduction in income, or an unexpected expense arises that your regular income can’t cover.

Job loss or pay reduction

Your emergency fund may best be used for unexpected and necessary expenses during job loss or a pay cut. When your regular monthly income can no longer cover your basic living needs, it’s probably time to use your emergency fund. Basic living needs include:

Rent or mortgage payment

Groceries

Utilities

Car-related expenses like gas and insurance

Medical-related expenses like necessary prescriptions and medications

Anything outside of these expenses should really be put on pause. Dig into your budget, bank or credit card statement and see what you can eliminate from your discretionary spending. For example, an emergency fund probably should not be used to cover your monthly gym membership, but it could cover a monthly diaper delivery service for your baby.

Make sure you apply for unemployment benefits immediately after receiving your termination notice so you can start collecting unemployment checks as soon as possible. Try to cover your basic living needs with your unemployment check, and then supplement spending with your emergency fund.

Unexpected expenses

Another reason you may decide to pull money from savings is to cover an unexpected expense. Regardless of whether you still have your job, emergencies happen. When the car dies or your HVAC needs to be replaced, an emergency fund can cover some or all of the costs. It can also help avoid additional debt. Other unexpected expenses you could cover with savings include:

Roof repairs

Medical emergency

Phone stops working

Pet health emergency

Family health emergency

Can your emergency fund be too big?

There’s no better financial peace than having a hefty emergency fund, but strangely enough, your fund can actually be too big – in other words, that money might be better used in another way. How do you know if you have too much? Evaluate your emergency fund by asking yourself:

How much are my monthly expenses?

How much of those expenses are necessary? (Rent, food, utilities, car expenses, etc.)

What is the total amount of the fund?

Take your emergency fund total and divide it by your necessary monthly expenses to figure out how many months you can cover in case of an emergency. Keep in mind most experts say you should have 3-6 months of living expenses in your emergency fund. If you find yourself with more than that, it might be more valuable to use the money to pay down debt.

Steps to help manage your money better

If you find yourself unable to pay down debt because you’re putting all your money into savings, use this simple process to manage your money better:

First, look up the interest rate on your debt. If you have multiple debts and interest rates, calculate the average rate you are paying.

Next, calculate your savings rate by dividing the amount you save each month by your total monthly income.

Compare your savings rate with the interest rate from your debt. Which number is higher? If the interest rate on your debt is 15%, for example, and your savings rate is 5%, then you’re still in the hole by 10% and it may be better to use your savings to pay off debt.

By paying off your debt, you can free up cash each month and improve your credit score. The extra cash flow can go into your savings again. Find the debt with the highest interest rate and pay that off first.

If you want to keep managing your savings, forbearance could help

Thinking about your emergency fund should be more about managing that money, instead of just saving vs. spending. For example, if you decide you need to keep your emergency fund more intact, you can protect your savings levels by using forbearance options with your lender. This is an option that could keep you from spending your emergency fund right now, giving you some breathing room. However, it’s only temporary and eventually, you will need to continue paying off your debt.

If you need debt relief in New York (or anywhere else in the country), explore your options. The first step is the most important one—find out more today.

When you’re unsure of which financial step to take

Saving and paying down debt are both important, but you don’t have to figure it out on your own. If you have already spent most of your emergency fund or find it difficult to pay off debt right now, it might be time to seek out advice. Freedom Debt Relief is here to help you understand your options, including our debt relief program. Our Certified Debt Consultants can help you find a solution that can help you move from overwhelmed to clarity. Find out if you qualify now.

Learn More:

Will COVID-19 Stimulus and Benefits be Extended? 5 Things to Know (Freedom Debt Relief)

Need to Skip a Loan Payment Because of COVID-19? Talk to Your Lender Now (Freedom Debt Relief)

Survey: Americans Can’t Cover Emergency Expenses (Freedom Debt Relief)

Americans Will Soon Need Extra Money They Saved in Lockdown (Bloomberg)

A look into the world of debt relief seekers

We looked at a sample of data from Freedom Debt Relief of people seeking the best debt relief company for them during January 2026. This data highlights the wide range of individuals turning to debt relief.

Credit utilization and debt relief

How are people using their credit before seeking help? Credit utilization measures how much of a credit line is being used. For example, if you have a credit line of $10,000 and your balance is $3,000, that is a credit utilization of 30%. High credit utilization often signals financial stress. We have looked at people who are seeking debt relief and their credit utilization. (Low credit utilization is 30% or less, medium is between 31% and 50%, high is between 51% and 75%, very high is between 76% to 100%, and over-utilized over 100%). In January 2026, people seeking debt relief had an average of 74% credit utilization.

Here are some interesting numbers:

| Credit utilization bucket | Percent of debt relief seekers |

|---|---|

| Over utilized | 30% |

| Very high | 32% |

| High | 19% |

| Medium | 10% |

| Low | 9% |

The statistics refer to people who had a credit card balance greater than $0.

You don't have to have high credit utilization to look for a debt relief solution. There are a number of solutions for people, whether they have maxed out their credit cards or still have a significant part available.

Student loan debt – average debt by selected states.

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) the average student debt for those with a balance was $46,980. The percentage of families with student debt was 22%. (Note: It used 2022 data).

Student loan debt among those seeking debt relief is prevalent. In January 2026, 27% of the debt relief seekers had student debt. The average student debt balance (for those with student debt) was $48,703.

Here is a quick look at the top five states by average student debt balance.

| State | Percent with student loans | Average Balance for those with student loans | Average monthly payment |

|---|---|---|---|

| District of Columbia | 34 | $71,987 | $203 |

| Georgia | 29 | $59,907 | $183 |

| Mississippi | 28 | $55,347 | $145 |

| Alaska | 22 | $54,555 | $104 |

| Maryland | 31 | $54,495 | $142 |

The statistics are based on all debt relief seekers with a student loan balance over $0.

Student debt is an important part of many households' financial picture. When you examine your finances, consider your total debt and your monthly payments.

Manage Your Finances Better

Understanding your debt situation is crucial. It could be high credit use, many tradelines, or a low FICO score. The right debt relief can help you manage your money. Begin your journey to financial stability by taking the first step.

Show source

Author Information

Written by

Justine Nelson

Justine Nelson is the founder of Debt Free Millennials, an online community to help millennials eliminate debt and live a debt free lifestyle. As a freelance writer and YouTuber, Justine enjoys creating upbeat and educational personal finance content. This Midwest millennial paid off $35k in student loan debt and now resides in San Diego with her husband.