Changes in Eviction Protection: Update

BySara Korn

UpdatedFeb 16, 2026

- Renters were extended protection from eviction because of COVID.

- Not all renters are covered -- you must have an application for COVID rental assistance.

- CDC COVID eviction protection expires June 30, 2022.

Table of Contents

On September 1, the Centers for Disease Control and Prevention (CDC) issued an order protecting qualifying renters in the U.S. from eviction beginning September 4, through December 31, 2020. This order extends the eviction protection from the CARES Act, which expired on July 24 and only protected those living in government-funded housing. The CDC order does not protect homeowners from foreclosure due to mortgage non-payment.

Why is the eviction protection order coming from the CDC?

In his executive order, President Trump gave the CDC authority to make a decision about halting evictions in the interest of public health. The eviction moratorium is based on concerns that people evicted from their homes would turn to congregate housing, such as homeless shelters, or move in with family members. More people living in close quarters can increase the spread of COVID-19.

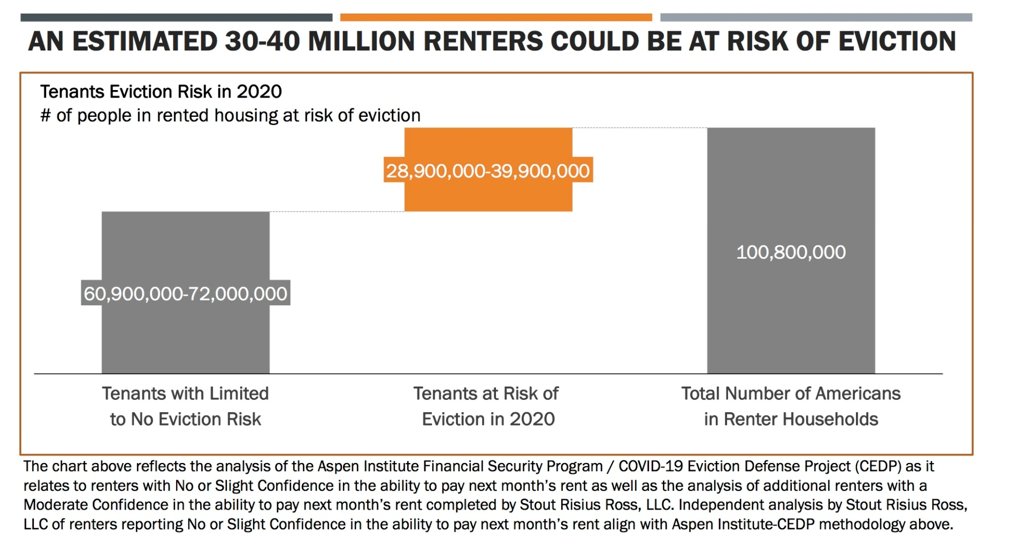

In short, it’s easier to social distance if everyone is in their own home. And given that around 40 million people are at risk of being evicted otherwise, the impact on public health—and on Americans’ lives—could be serious.

Chart courtesy of the Aspen Institute

Who is covered by the CDC eviction protection?

To qualify under the CDC guidelines, a renter must:

Be unable to pay the full rent due to loss of income, loss of wages, layoff, or extraordinary out-of-pocket medical expenses

Have made every effort to get any available government financial assistance

Expect to earn no more than $99,000 in annual income in 2020, or wasn’t required to file a 2019 tax return, or received a stimulus check as part of the CARES Act

Whenever possible, make rent payments as close to the full amount as possible

Have no other housing options and therefore be in danger of becoming homeless or having to move into close quarters with others

Even if renters qualify under these criteria, it’s important to note that they can still be evicted for breaking any other parts of their lease agreement, such as property damage or disorderly conduct.

Will renters still owe rent if they qualify for eviction protection?

Yes. The amount a tenant usually owes will still be due to the landlord eventually, either once all rental moratoria in the area expires or when the tenant no longer meets the qualification criteria. At that point, depending on the terms of the lease agreement and the willingness of the landlord to work with their tenant, the landlord may:

Sue to evict unless all back rent is paid immediately

Allow a back-rent payment plan, probably in addition to the cost of normal rent

The CDC order also says that landlords have the right to charge any fees, penalties, or interest according to the terms of the lease agreement. So while the CDC eviction protection order provides much-needed temporary relief from eviction for many households, it’s just that — temporary.

What should renters do if they receive an eviction notice?

If a tenant receives an eviction notice even though they believe they qualify for eviction protection, they should:

Make sure they meet the criteria to qualify

Complete the form provided by the CDC for each person on the lease agreement

Give the completed form(s) to their landlord

Who does not have eviction protection?

It’s important to understand the CDC eviction protection order won’t prevent eviction if the renter:

Meets some, but not all, of the qualification criteria

Violates other parts of the lease agreement that could lead to eviction

Lives in temporary housing (like an extended stay hotel or seasonal housing)

Is a resident of American Samoa (where there are no COVID cases)

Is a homeowner paying a mortgage, not rent

If you’re a homeowner who can’t pay your mortgage due to the coronavirus crisis, or you own a rental property and can’t make your mortgage payments because your tenants aren’t paying rent, a good course of action is to contact your mortgage lender and ask them if they can defer your payments or accept partial payments.

What about state and local eviction protections?

State or local rental moratoria will prevail if they give more rights to renters than the CDC eviction protection order. For example, California’s new state law states that any back rent owed by tenants after the moratorium ends can’t be grounds for eviction at that time, which is an extra bit of protection not included in the CDC order. The California law also extends the moratorium to January 31, 2021, a full month later than the CDC order.

Do an internet search for eviction protection in your state, county, and city. You can also look for helpful online summaries of government protections for renters.

What to do next:

If you qualify for eviction protection, make sure you:

Seek all possible forms of financial assistance from federal, state, and local sources

Fill out the CDC declaration form and give it to your landlord

Prioritize paying rent over less important bills like discretionary expenses and unsecured debt payments

Pay as much as you can toward rent each month to reduce the amount of back rent you’ll owe

Relief from credit card payments

If you’re unable to pay both rent and credit card payments due to a financial hardship, you may want to consider debt relief. Through a debt relief program, you creditors may be willing to settle for less than you owe on some or all of your unsecured debts. To learn more, talk to a Freedom Debt Relief Certified Debt Consultant. They can either help you find out if you qualify for our debt relief program, or help you find another debt solution that could help. Get started now.

Learn More:

Does Eviction Protection Still Apply to You? (Freedom Debt Relief)

If You Missed Your Stimulus Check for Dependents, You have Another Chance (Freedom Debt Relief)

3 Things You Might Need More Than a Stimulus Check (Freedom Debt Relief)

Reducing Expenses During a Sudden Financial Hardship (Freedom Debt Relief)

If you need debt relief in Davenport, IA (or anywhere else in the country), explore your options. The first step is the most important one—find out more today.

Debt relief by the numbers

We looked at a sample of data from Freedom Debt Relief of people seeking credit card debt relief during January 2026. This data reveals the diversity of individuals seeking help and provides insights into some of their key characteristics.

Credit utilization and debt relief

How are people using their credit before seeking help? Credit utilization measures how much of a credit line is being used. For example, if you have a credit line of $10,000 and your balance is $3,000, that is a credit utilization of 30%. High credit utilization often signals financial stress. We have looked at people who are seeking debt relief and their credit utilization. (Low credit utilization is 30% or less, medium is between 31% and 50%, high is between 51% and 75%, very high is between 76% to 100%, and over-utilized over 100%). In January 2026, people seeking debt relief had an average of 74% credit utilization.

Here are some interesting numbers:

| Credit utilization bucket | Percent of debt relief seekers |

|---|---|

| Over utilized | 30% |

| Very high | 32% |

| High | 19% |

| Medium | 10% |

| Low | 9% |

The statistics refer to people who had a credit card balance greater than $0.

You don't have to have high credit utilization to look for a debt relief solution. There are a number of solutions for people, whether they have maxed out their credit cards or still have a significant part available.

Collection accounts balances – average debt by selected states.

Collection debt is one example of consumers struggling to pay their bills. According to 2023, data from the Urban Institute, 26% of people had a debt in collection.

In January 2026, 30% of debt relief seekers had a collection balance. The average amount of open collection account debt was $3,203.

Here is a quick look at the top five states by average collection debt balance.

| State | % with collection balance | Avg. collection balance |

|---|---|---|

| District of Columbia | 23 | $4,899 |

| Montana | 24 | $4,481 |

| Kansas | 32 | $4,468 |

| Nevada | 32 | $4,328 |

| Idaho | 27 | $4,305 |

The statistics are based on all debt relief seekers with a collection account balance over $0.

If you’re facing similar challenges, remember you’re not alone. Seeking help is a good first step to managing your debt.

Tackle Financial Challenges

Don’t let debt overwhelm you. Learn more about debt relief options. They can help you tackle your financial challenges. This is true whether you have high credit card balances or many tradelines. Start your path to recovery with the first step.

Show source

Author Information

Written by

Sara Korn

Sara Korn is a freelance writer who enjoys guiding people to helpful solutions and new and better ways of reaching their goals. She loves stories both on screen and on the page, and is passionate about learning, growing, and teaching.