Almost Half of Americans Are Earning Less Than Before COVID

UpdatedFeb 17, 2026

- One in five Americans experienced income loss due to COVID.

- Help for those affected includes payment forbearance, disaster relief loans and stimulus checks or Recovery Rebate Credits.

- Debt settlement can be a viable option for those worst-hit by the pandemic.

Table of Contents

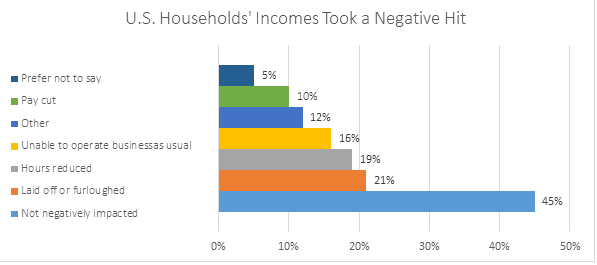

The pandemic has created a strenuous environment for many Americans, especially when it comes to their finances. Even as 2020 comes to an end, nearly half of working Americans say their income is still less than what it was pre-pandemic. While vaccines bring the hope that things will eventually return to something like normal, financial relief is still needed for those experiencing a loss of income.

Whether due to job loss, fewer hours, or furlough, income levels have dropped across the country. Let’s take a look at who has been affected by income loss during the pandemic, and what anyone effected can do to help themselves financially, starting now.

1 in 5 Americans experienced income loss

The unemployment rate hit an all-time high in 2020, resulting in one in five Americans experiencing a financial setback. Workers have been furloughed, taken pay cuts, and had their hours reduced, forcing many into seeking hardship programs for loans, or taking other steps to offset those losses.

Source: Bankrate survey, Nov. 11-13, 2020

Lack of income has also changed spending habits during the pandemic, with many of us spending less on travel and entertainment, sometimes adding spending on items like education and home fitness, and putting more into savings, when possible.

Gen Z, millennials, and Gen X hit the hardest

Although the pandemic has been felt by everyone, younger generations have been hit the hardest if not with illness, with income loss. A whopping 63% of Gen Z and millennials, those between the ages of 18-23 and 24-39, reported that their income took a negative hit, according to this Bankrate survey. To add insult to injury, these generations already carry heavy student loan debt and have even delayed major life events because of their finances, compared to older generations, who have less student debt burden.

In the same survey, only 37% of baby boomers experienced a negative impact to their finances, which may show the older generations have higher financial and job security. As a side effect of this financial security for baby boomers however, more of their adult children moving back home to make ends meet with the help of their family.

A shift in job creation and elimination

The roller coaster of small business shutdowns and reopening’s throughout the country have made it hard for workers, young and old, to maintain a steady paycheck. Those who work in retail and food service industries have felt this hardship the most. Hiring retail workers has stalled, with more than 35,000 jobs lost in the retail sector.

Despite the loss in retail jobs, transportation and warehousing saw an increase in 145,000 jobs as more Americans resort to online shopping and front porch delivery for many of their purchases. However, even though jobs in some industries have increased, it doesn’t necessarily translate to more income. Some of the additional jobs are lower wage, part-time, or lack crucial benefits like health insurance and sick time.

What relief is coming in 2021?

As we close out 2020, still in full pandemic mode, the New Year may bring a light dusting of optimism to those struggling to make ends meet. There’s been plenty of discussion about a potential second stimulus package, but what’s more realistic and accessible now? Here is the latest on financial relief programs in 2021:

Federal student loan forbearance has been extended to January 31. Borrowers gain an extra month of the freeze on payments and interest.

Economic Injury Disaster Loans (EIDL) are still available to help businesses meet financial obligations and expenses. The first payment is deferred one year and the loan amount is equal to six months of working capital.

Eligible tax filers can claim the Recovery Rebate Credit on their tax return if they never received an economic stimulus check.

Deferred payments or loan modifications from private banks and lenders are still available to those who request it. For example, Ally Bank is providing payment assistance options and USAA has flexible options for those with consumer loans, mortgages, or credit cards.

What you can do now

Relief options from private lenders and the government are helpful, but it’s not sustainable over the long term to rely on additional stimulus packages. Instead, focus on what you can do to help yourself. There are plenty of good financial habits that you can set into motion now to start off the New Year on the right foot.

Monthly budgeting: Start tracking your income and expenses. Review expenses that you can temporarily reduce or cut so your money goes towards necessities like rent, food, utilities, and car-related expenses.

Gather debt information: If you have debt in multiple areas, organize it all in a spreadsheet. Collect information including total balance, interest rate, and monthly minimum payment. You can also obtain your credit report for free to make sure you don’t miss anything.

Make a debt payoff plan: Whether you DIY your debt free journey, or need help from a debt relief program, a plan can help you feel less overwhelmed even when income seems tight.

When life and finances seem a little chaotic …

You don’t have to manage your debt situation alone. By speaking with one of Freedom Debt Relief’s Certified Debt Consultants, you can review several options to help you address your unsecured debt. Get started for free here.

Learn more:

What the Latest Jobs Report Could Mean for Your Finances (Freedom Debt Relief)

Household Wealth Grew This Year – Why Doesn’t it Feel Like it? (Freedom Debt Relief)

For Families with Multiple Generations Under One Roof, the Pandemic Has Brought Unique Challenges (CNBC)

Pausing Loan Payments During Coronavirus is Producing Uneven Results (Wall Street Journal)

If you need debt relief in New Mexico (or anywhere else in the country), explore your options. The first step is the most important one—find out more today.

Debt relief stats and trends

We looked at a sample of data from Freedom Debt Relief of people seeking a debt relief program during January 2026. The data uncovers various trends and statistics about people seeking debt help.

FICO scores and enrolled debt

Curious about the credit scores of those in debt relief? In January 2026, the average FICO score for people enrolling in a debt settlement program was 593, with an average enrolled debt of $25,843. For different age groups, the FICO scores varied. For instance, those aged 51-65 had an average FICO score of 588 and an enrolled debt of $27,829. The 18-25 age group had an average FICO score of 556 and an enrolled debt of $17,051. No matter your age or debt level, it's reassuring to know you're not alone. Taking the step to seek help can lead you towards a brighter financial future.

Home-secured debt – average debt by selected states

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) (using 2022 data) the average home-secured debt for those with a balance was $212,498. The percentage of families with mortgage debt was 42%.

In January 2026, 25% of the debt relief seekers had a mortgage. The average mortgage debt was $236504, and the average monthly payment was $1882.

Here is a quick look at the top five states by average mortgage balance.

| State | % with a mortgage balance | Average mortgage balance | Average monthly payment | |

|---|---|---|---|---|

| California | 20 | $391,113 | $2,710 | |

| District of Columbia | 17 | $339,911 | $2,330 | |

| Utah | 31 | $316,936 | $2,094 | |

| Nevada | 25 | $306,258 | $2,082 | |

| Massachusetts | 28 | $297,524 | $2,290 |

The statistics are based on all debt relief seekers with a mortgage loan balance over $0.

Housing is an important part of a household's expenses. Remember to consider all your debts when looking for a way to get debt relief.

Tackle Financial Challenges

Don’t let debt overwhelm you. Learn more about debt relief options. They can help you tackle your financial challenges. This is true whether you have high credit card balances or many tradelines. Start your path to recovery with the first step.

Show source

Author Information

Written by

Justine Nelson

Justine Nelson is the founder of Debt Free Millennials, an online community to help millennials eliminate debt and live a debt free lifestyle. As a freelance writer and YouTuber, Justine enjoys creating upbeat and educational personal finance content. This Midwest millennial paid off $35k in student loan debt and now resides in San Diego with her husband.