Guide to Credit Scores

UpdatedJan 17, 2026

- Your credit score tells lenders how likely you are to repay your debts on time.

- Most people have many credit scores based on different formulas.

- A good or excellent credit score could lower your borrowing costs, and that could help you save money over your lifetime.

Table of Contents

Once you learn how the pieces of your credit score fit together, building and maintaining good credit could be a whole lot easier.

Your credit score is a snapshot of your history with credit accounts, translated into a number that lenders can quickly understand. In a nutshell, the number represents how likely you are to repay a debt.

We’ll explain what affects your credit scores, how different kinds work, and how to use your credit score knowledge to start building a better financial future. You have control over your credit score, whether you're starting from scratch or recovering from a credit setback.

How Is Your Credit Score Determined?

A credit score is a number that sums up the information in your credit report. A credit report is a record of your credit and debt accounts, including balances and payment history. The data is put together and managed by credit bureaus. In the U.S., the three main consumer credit bureaus are:

Equifax

Experian

TransUnion

Your credit reports show how much debt you have, who you owe, and whether you've been making all of your payments as agreed. What they don't include are any credit scores.

Credit scores are based on the data in your credit reports. Most credit scores, though, are obtained through a third-party credit scoring agency. These agencies use credit scoring models—complicated algorithms that assign values to the data in your credit reports—to calculate your credit scores.

Your credit scores can vary widely depending on the scoring model used to calculate it. Most lenders will use a scoring model from one of two agencies: FICO or VantageScore.

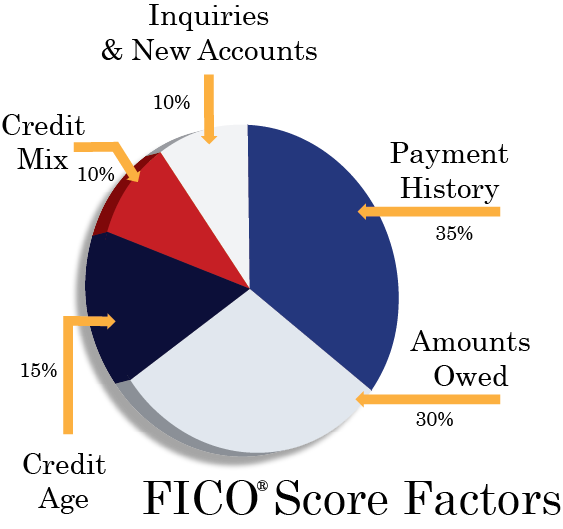

How FICO Calculates Your Credit Score

The most commonly used credit scoring models come from FICO (short for Fair Isaac Corporation). FICO has developed a variety of scoring models that are slightly different from one another. For example, there are specific scores for auto lenders and mortgage lenders. In general, FICO Scores weigh these five factors when calculating your credit score:

35% Payment history. On-time payments are the most important factor in a good credit score. Payments can be reported as late to the credit bureau when they're more than 30 days past due.

30% Amounts owed. This factor measures all of your debt, and credit card balances play a big part. High credit card balances tend to bring your credit score down.

15% Length of credit history. The longer you’ve had open credit accounts, the better for your score. FICO looks at the age of your oldest account and the average age of all of your accounts.

10% Credit mix. Scoring models (and lenders) like to see a mix of credit types. For example, it’s good to have experience with both revolving credit accounts (credit cards) and installment loans (such as a car loan).

10% New credit. This refers to credit inquiries that could happen each time you apply for a new credit account. Each inquiry could drop your score by a few points.

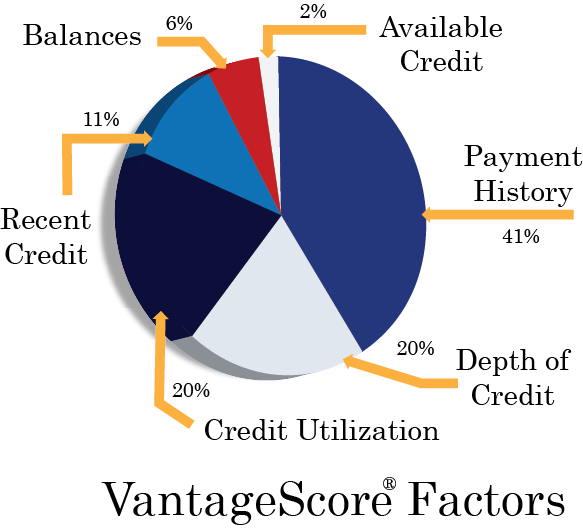

How VantageScore Calculates Your Credit Score

VantageScore credit scores aren't used quite as often as FICO Scores, but they are used by thousands of lenders nationwide. They are also used by many free credit score providers online. Here is how they weight their scores:

41% Payment history. VantageScore places even more emphasis on on-time payments than FICO. The same caveat applies, that payments need to be 30 days past due to be reported as late on your reports.

20% Depth of credit. This is similar to the credit mix category in the FICO model, and it reflects the types of credit you have and use. A mix of revolving credit and installment loans looks best.

20% Credit utilization. This is your credit card balance compared to your credit limit. . VantageScore looks at your overall utilization as well as each credit account individually.

11% Recent credit. Hard credit inquiries and opening new accounts will impact your credit score through this factor.

6% Balances. VantageScore weighs your current debt balances in this category, separate from your utilization.

2% Available credit. Your total available credit is also considered separately from your utilization. A larger amount of total available credit can have a positive impact on your VantageScore.

What Are Credit Score Ranges?

Each credit scoring model has a minimum score and a maximum score that determine its range. The most common credit scores range from 300 to 850, with 300 being the lowest score and 850 being the highest possible score.

But what does that number actually mean? Here's how FICO and VantageScore divide their score ranges.

FICO Score ranges

FICO has a fairly broad range for good credit, but you need to be way up there to have excellent credit in its book:

300-579 Poor

580-669 Fair

670-739 Good

740-799 Very Good

800-850 Exceptional

The average FICO Score in the U.S. is solidly in the "good" category: In 2024, it's 715.

VantageScore ranges

VantageScore uses different labels for its ranges, but the concepts are the same. High Superprime scores are the best, while low subprime scores are less desirable:

300-600 Subprime

601-660 Near prime

661-780 Prime

781-850 Superprime

The average VantageScore is lower than the average FICO Score, but it's still in the Prime category. In 2024, the average VantageScore was 705.

What Is a Good Credit Score?

FICO defines a good credit score as 670 to 739, and VantageScore considers scores between 661 and 780 to be Prime (similar to good). However, creditors get to decide for themselves what score they’ll consider excellent, good, bad, or somewhere in between. Their tiers can vary a lot.

For example, you may have a good credit score according to one bank, but only a fair score according to another. Similarly, the same credit score that gets you approved for a credit card may not be high enough to get a mortgage.

What's a good credit score for a mortgage?

You can, in theory, get an FHA home loan with a credit score as low as 500 if you can afford to make a 10% down payment on the home. However, very few loans are approved with scores this low. Even though the FHA program allows FICO Scores as low as 500, it doesn't allow recent bankruptcies. That rule shuts out people whose scores are low because of bankruptcy.

Most lenders set their minimum acceptable credit score for a mortgage at 620 or higher. Many programs require a 680, 720, or even 740.

What's a good credit score for a car loan?

You could qualify a car loan with a credit score of 660 or higher. However, to get the best auto loan rates, rebates, and other perks dealers advertise, you probably need a score closer to 760 than 660.

What's a good credit score for a credit card?

A score of 670 or higher could qualify for many cards at average interest rates. To get the best credit cards, however, you'll need excellent credit. If your score is 800 or higher, you have a better chance at approval for almost any credit card on the market.

How to Check Your Credit Score for Free

You can get a free credit report at the federal government's site, AnnualCreditReport, once a week. You have three credit reports (from TransUnion, Experian, and Equifax). They aren’t identical because all creditors don’t report to all three bureaus. It’s a good idea to check all three regularly to keep tabs on your credit.

The government doesn't provide your credit scores. The good news is that free credit scores are widely available from many sources, including

Experian (FICO Score), if you sign up for a free account

Equifax (FICO Score), if you sign up for a free account

Credit unions and banks (many offer free credit scores to their customers)

Many major credit card companies, including American Express, Bank of America, Citibank, Commerce Bank, and Discover

Personal finance sites like Credit Karma and Credit Sesame (VantageScore)

When you get a free credit score, you’ll have to give up your personal information. That could land you on some marketing lists. Be prepared to unsubscribe from marketing emails or otherwise change your settings if that’s your preference. Most providers of free credit scores also offer credit monitoring services. The basic level might be free. They also sell premium credit monitoring and identity theft prevention.

You never have to enter your credit card number to get a free credit report or free credit score. If you land on a page that requires it, close the window and start over.

How to Increase Your Credit Score

The first step to improving your credit score is checking your credit reports and scores so you know where you stand. Then, you can work on addressing anything that needs fixed. Here are some strategies that may help.

Dispute inaccurate information on your credit report

Over one-third of credit reports in the U.S. have incorrect information, and in many cases, those errors could lower your score. A lower score could cause you to pay more for credit or be denied altogether. Go through your report and ensure that the accounts listed are yours and that any derogatory entries aren't errors.

You can dispute errors online or by mail with the bureaus. For some disputes, you might be asked to provide documentation to back up your claim, so if you already have it, provide it. If you paid a bill on time, upload your bill pay statement or canceled check. Remember that an account isn't delinquent until 30 days past due.

If you're applying for a mortgage, your lender can help you get rid of errors much faster with something called a rapid rescoring service. The fee is modest and can clear an error in a day or two, while the normal process can take 30 days.

Check your reason codes

FICO Scores come with reason codes that tell you the factors causing your score to be lower than it could be. Here are some common reasons for lower scores:

Serious delinquency

Public record (including bankruptcy) or collection account

Time since delinquency is too recent or unknown. Things that happened in the recent past tend to have more weight than things that happened years ago.

Level of delinquency on accounts is too high (120 days late hurts more than 30 days late)

Amount owed on accounts is too high

Ratio of balances to credit limits on revolving accounts is too high (this is your credit utilization)

Length of time accounts have been established is too short

Too many accounts with balances

Once you know why your credit score is low, you can do something about it.

If you have no credit or not much credit

If your issue is a short or limited credit history, there are steps you could take to become more visible. Here’s how:

Become an authorized user on one or more accounts. This is a big favor to ask of someone because you’ll be authorized to use their account but not responsible for paying the bill. Authorized user status could have a positive impact on your credit standing if the account has a low balance and an excellent payment history.

Apply for a starter credit card for people with no credit history, such as a student card. Or one that caters to people with fair or low credit scores.

Apply for a secured credit card. These cards require a refundable deposit but are among the easiest to get. Look for a secured credit card with no annual fee.

Apply for a small credit builder loan and pay it back promptly. With a credit builder loan, you have to make payments before the money is disbursed to you.

If you rent, look into a rent reporting service. Some are free, and others have a fee. All three credit bureaus will add rent to your credit report if they get it, and newer versions of FICO and VantageScore incorporate rent payments into your credit score.

Your credit score is fluid. Any new data that shows up on your credit report could change your score. For that reason, it’s possible to start changing your credit score right away. A perfect score takes years to build, but a solid, healthy credit standing could be within reach much sooner.

If you have bad credit

Bad credit is far from permanent, and it’s possible to improve it with a bit of time and effort. Most negative items will automatically fall off your credit reports after seven years, though some bankruptcies can last up to 10 years. Also, as negative items get older, they have less effect on your score.

In the meantime, work on rebuilding a positive payment history by paying all of your bills and debts on time every month. A good way to stay on time is to set up automatic payments that make at least your minimum payment automatically each billing cycle. As long as you satisfy the minimum on time, you get credit for an on-time payment.

It’s possible to add more data to your credit reports by using the same tactics as a person with no credit: Become an authorized user on an account with a good payment history, and consider applying for a secured credit card or credit-builder loan.

If you owe too much

A strong sign that credit card debt is holding down your score is a reason code like one of these:

Too many accounts

Too many accounts with balances

Amounts owed are too high

These codes likely mean that your utilization ratio is too high.

Your credit utilization ratio is the total of your credit card balances divided by your total available credit. For instance, if you have three credit cards that each have a $1,000 limit, your available credit is $3,000. If your balances equal $2,000, your credit utilization is 67%. That's a high ratio.

2,000 / 3,000 = 0.67 or 67%

There are two ways to lower a credit utilization ratio:

Lower your credit card debt balances. This is the golden rule of money management and credit health. It’s easier said than done, but good things will follow if you can pay off your credit card debt. You could save money on interest, get a credit score boost, lower your stress levels, and work on other financial goals. Lingering credit card debt is sometimes unavoidable but it’s never desirable.

There is a way to lower your credit card balances without paying them off: debt consolidation. For example, if you qualify for a personal loan and use it to pay off your credit cards, your utilization ratio would drop to zero. This strategy doesn’t reduce your debt. It could backfire if you add new debt to your paid-off cards after you consolidate the balances.

Increase your credit limits. Using our example above, if you have $2,000 in credit card debt but your total credit limit is $5,000, your utilization is only 40%, which is better than 67% and much less harmful to your credit standing. If you’ve been making your payments on time for a while, you could ask your credit card issuers to increase your limits.

Warning: Your request might trigger a hard credit inquiry. Each hard inquiry could ding your credit score by a few points. This is separate from any effect that your utilization ratio has on your credit score.

Ultimately, it’s best to focus on long-term debt solutions, not temporary fixes designed to push your credit score up. Your financial health is more important than your credit score, and has a bigger long-term impact on your life. You could accelerate repayment with a debt snowball or debt avalanche plan.

If you can’t afford to fully repay your debts and you’re not sure what to do, talk to a debt settlement company about whether you’re a candidate for debt settlement. Settling debts means getting the creditor to agree to accept less than the full amount you owe but consider it payment in full. Sometimes creditors are willing to do this if you have a financial hardship. Clearing your debts could put you in a better position to build and maintain great credit in the future.

People with higher credit scores pay less for credit and have an easier time getting it. Ultimately, improving your credit score could also increase your financial security. It's well worth your energy.

A look into the world of debt relief seekers

We looked at a sample of data from Freedom Debt Relief of people seeking the best debt relief company for them during December 2025. This data highlights the wide range of individuals turning to debt relief.

Credit Card Usage by Age Group

No matter your age, navigating debt can be daunting. These insights into the credit profiles of debt relief seekers shed light on common financial struggles and paths to recovery.

Here's a snapshot of credit behaviors for December 2025 by age groups among debt relief seekers:

| Age group | Number of open credit cards | Average (total) Balance | Average monthly payment |

|---|---|---|---|

| 18-25 | 3 | $8,877 | $272 |

| 26-35 | 5 | $12,187 | $375 |

| 35-50 | 6 | $16,024 | $431 |

| 51-65 | 8 | $16,739 | $524 |

| Over 65 | 8 | $17,477 | $488 |

| All | 7 | $15,142 | $424 |

Whether you're starting your financial journey or planning for retirement, these insights can empower you to make informed decisions and work towards a more secure financial future

Credit card debt - average debt by selected states.

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) the average credit card debt for those with a balance was $6,021. The percentage of families with credit card debt was 45%. (Note: It used 2022 data).

Unsurprisingly, the level of credit card debt among those seeking debt relief was much higher. According to December 2025 data, 88% of the debt relief seekers had a credit card balance. The average credit card balance was $16,010.

Here's a quick look at the top five states based on average credit card balance.

| State | Average credit card balance | Average # of open credit card tradelines | Average credit limit | Average Credit Utilization |

|---|---|---|---|---|

| Alaska | $18,904 | 7 | $24,102 | 81% |

| District of Columbia | $16,247 | 9 | $28,791 | 78% |

| Alabama | $13,021 | 9 | $27,261 | 78% |

| Oklahoma | $13,959 | 8 | $25,731 | 77% |

| Kentucky | $12,599 | 8 | $26,156 | 77% |

The statistics are based on all debt relief seekers with a credit card balance over $0.

Are you starting to navigate your finances? Or planning for your retirement? These insights can help you make informed choices. They can help you work toward financial stability and security.

Manage Your Finances Better

Understanding your debt situation is crucial. It could be high credit use, many tradelines, or a low FICO score. The right debt relief can help you manage your money. Begin your journey to financial stability by taking the first step.

Show source

Author Information

Written by

Brittney Myers

Brittney is a personal finance expert and credit card collector who believes financial education is the key to success. Her advice on how to make smarter financial decisions has been featured by major publications and read by millions.

What is the difference between a credit report and a credit score?

A credit report contains your credit information. That includes your credit limits, account balances, payment amounts, and payment history. It also shows inquiries (when you apply for credit and a lender pulls your credit report), public records like lawsuits or bankruptcies, and collection accounts. Your credit report also contains personal information like your date of birth, social security number, address, and employment information. This personal information is not a factor in credit scoring.

A credit score is a number calculated from the information contained in your credit report. The score makes it easier for lenders to make decisions. Instead of looking through your entire credit report, lenders can set minimum credit scores for eligible applicants.

Why are my credit reports different?

Your credit reports are generated by different companies. They are Equifax, Experian, and TransUnion. Creditors send information to them. There’s a cost involved in reporting, so some creditors don’t report to all three.

It’s normal for your credit reports to be different. The important thing is that they should be accurate. If you notice anything on your credit report that’s wrong, you can dispute it with the company that made the credit report. Disputing is easy to do when you’re viewing your credit report online, and most of the time that’s all it takes to get mistakes corrected.

How many credit scores are there?

You have many different credit scores because there are many scoring models, and each model can be applied to credit reports from the three credit reporting agencies.

The credit score that you get if you request a credit score is an “educational” score that lenders don’t use to make decisions. There are credit scoring models for different kinds of loans and for insurers and employers.

It makes sense, then, that you have many credit scores. FICO alone has 16 credit scores. VantageScore has four. If there are 20 versions of credit scoring models applied to three reports, that’s 60 different credit scores!

But wait; there’s more. FICO has come out with newer scoring models, including the FICO Score 10 Suite which includes a base FICO Score 10, a FICO Score 10 T (which includes trended data), and new industry-specific scores. And FICO is rolling out its UltraFICO Score, which lets you link checking, savings, or money market accounts and incorporates banking activity. Lenders even create custom credit scoring models.